Proactive Investors -

- FTSE 100 heads back to parity after early falls

- UBS rescues Credit Suisse (SIX:CSGN) in US$3.25bn deal

- Central banks launch new liquidity measures

Crisis, what crisis?

London's lead index has all but erased all of its earlier losses in a volatile start to trading.

The FTSE 100 is now flirting with opening levels currently at 7,330.93, down 4.47 points, or 0.1%. It briefly popped into positive territory.

Mining companies lead the way with Endeavour Mining PLC up 6.3%, Fresnillo up 4.1%, Anglo American up 3.2% and Antofagasta up 2.3%. Hopes that the banking crisis may be contained limiting economic damage have prompted buyers to snap up stocks on hopes of increased demand. Glencore, up 2.3%, received an additional boost from UBS which put the stock on its 'buy' list.

Water utilities aren't far behind with United Utilities rose 2.2%, Severn Trent up 1.9%, and Pennon up 2.4%.

Financial stocks continue to lead the fallers with Asia-focused insurer, Prudential PLC, top of the pile, down 5%. But bank although lower are well above worst levels for the day.

Water shares buck the weaker trend

Amongst the market mayhem, water utilities were a rate bright feature. Stocks reacted positively despite the industry watchdog announcing new powers over the payment of dividends.

The industry regulator Ofwat announced new powers that will enable it to stop the payment of dividends if they would risk the company's financial resilience, and take enforcement action against water companies that don't link dividend payments to performance.

The change will require company boards to take account of their performance - for customers and the environment - when deciding whether to make dividend payments. It will also require companies to maintain a higher level of overall financial health.

But there was no mention of immediate punitive measures amid growing political pressure following the repeated release of sewage into UK rivers. United Utilities rose 2.2%, Severn Trent up 1.9%, and Pennon up 2.4%.

Bond writedown spooks investors

Russ Mould at AJ Bell noted: “Everything is moving so quickly in the banking sector that as soon as you think the main issue is sorted, along comes another worry.”

“The takeover of Credit Suisse by UBS was done fast and should have provided reassurance to the market that we haven’t had another bank collapse.”

“However, what it has done is exposed the issues around AT1 bonds, also known as additional tier-one bonds.”

He explained “AT1 bonds are a form of contingent convertibles. They can be converted into equity or written down entirely if certain conditions are met, with the decision triggered by capital strength falling below a pre-determined level – i.e., when the issuer gets into trouble.”

“These bonds typically offer high yields to reflect the additional risks.”

“The Swiss financial regulator has ordered that Credit Suisse’s AT1 bonds be written down to zero. That appears to have spooked investors and has led to a sell-off in other bank debt and that’s weighed on share prices.”

“It means the banking crisis we’ve seen over the past few weeks has started a new chapter rather than reaching its ending.”

He highlighted the plight of investors holding exchange-traded fund Invesco AT1 Capital Bond ETF, whose share price slumped nearly 14%. It tracks the performance of an index of AT1 bonds including some issued by Credit Agricole, Barclays, Lloyds (LON:LLOY) and UBS.

FTSE 100 off lows, gold price rises further

The FTSE has bounced off its early lows and is now down just 50 points at 7,285, above earlier lows of 7,207.

Victoria Scholar, head of investment, interactive investor said: “UBS’ acquisition of Credit Suisse is the key focus for markets today with European bourses still under pressure despite the rescue deal. "

"The FTSE 100 is trading lower with financials including Standard Chartered, Barclays , Lloyds and NatWest (LON:NWG) trading at the bottom of the basket. Banks, financial services, and insurance are the worst performing sectors across Europe."

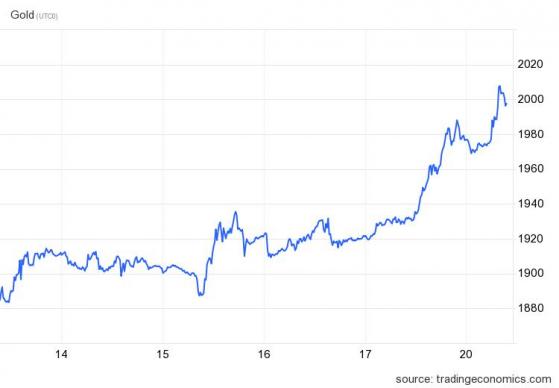

Safe haven assets such as gold and even bitcoin have been beneficiaries from the turmoil in the banking sector.

The price of the ‘yellow metal’ topped US$2,000 per ounce earlier after rising strongly over the past week as investors seek safer stores of value.

In a similar manner, Bitcoin has also advanced a further 4.6% to US$28,315.17.

Stephen Innes, at SPI Asset Management, said the markets risk being pulled into a ‘horrible negative feedback loop’, as authorities take action to (they hope) stem the crisis.

“No, if and or buts; price action in oil and safe-havens gold and yen suggests folks are still spooked, hinting we are in the process of devolving from a bank to an economic crisis when growth becomes more concerning than the crisis itself.”

“And if that proves accurate, a negative equity-bond correlation should see gold push higher and oil continues to tank.”

“Compounding matters is that the more policymakers do, the more investors expect bad news to come down the pipe, which creates a horrible negative feedback loop, almost as if investors are asking themselves “what do they know we do not know?”