By Ross Kerber

BOSTON (Reuters) - An investor committee that advises the U.S. Securities and Exchange Commission will next week review if Snap Inc 's (NYSE:SNAP) decision to deny shareholders voting rights might also reduce the social media company's public disclosures on executive pay and other governance matters, the head of that committee told Reuters on Wednesday.

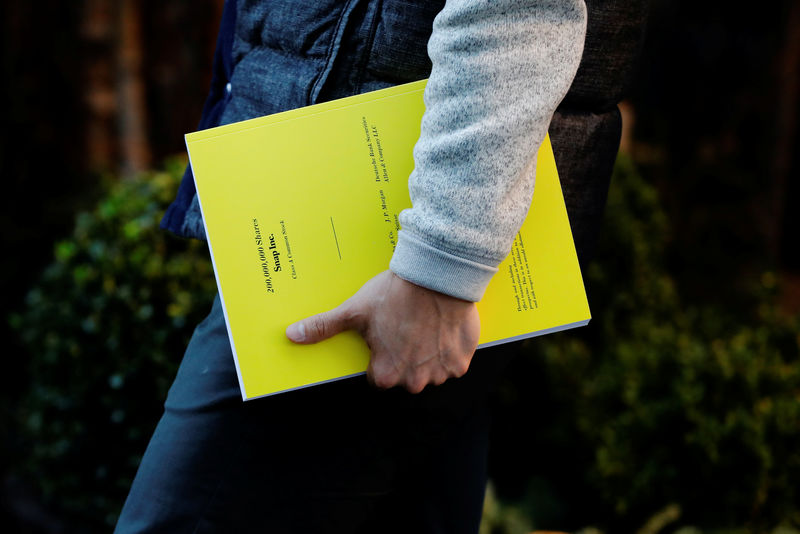

Snap, the parent of the popular messaging app Snapchat, priced its eagerly awaited initial public offering at $17 per share on Wednesday, above the expected range, giving the company a value of close to $24 billion, the richest in a U.S. tech IPO since Facebook Inc (NASDAQ:FB) in 2012.

The IPO shares will give investors no voting rights, an unprecedented feature that has raised concerns among corporate governance leaders that other high-valuation companies may follow suit and leave investors with little say over company operations.

Snap insiders and early investors hold shares with voting rights, giving them control of the company.

For Snap, "The question becomes, since there are no common shareholders' proxy votes to do, what does that do to the level of disclosures it will have to do for annual meetings and annual reports," Kurt Schacht said in a telephone interview.

Schacht is chairman of the SEC's Investor Advisory Committee, which makes recommendations to the regulator and was set up by the 2010 Dodd-Frank financial reforms. The SEC does not have to follow its suggestions. Schacht is managing director of the CFA Institute, which accredits investment professionals.

The committee has a meeting scheduled for March 9 that will include a discussion on "unequal voting rights of common shares," according to a published agenda for the session.

RACE TO BOTTOM?

Schacht said a concern was that Snap's non-voting shares could inspire other unicorns - the unofficial name for privately held technology companies with valuations of over $1 billion - to follow suit.

"We feel it's worth asking the question of, is this a one-off novelty pump-and-dump IPO, or is this a new trend with these unicorns?" he said. If so, he said that would "a troubling race to the bottom."

A Snap representative declined to comment.

In a Feb. 27 securities filing, Venice, California-based Snap said it will invite its new non-voting shareholders to its annual meetings and to submit questions. It also said it will provide them "the same proxy statements, information statements, annual reports, and other information" it delivers to those who hold its other classes of stock, including Chief Executive Evan Spiegel.

But the company may disclose some information to investors up to four days after a material event has occurred, the filing states. In the filing, Snap also calls itself an "emerging growth company" under U.S. law, leaving it free to exempt itself from some reporting requirements.

The scheduled review is only the latest test of transparency for Snap, which has gained a reputation for secrecy befitting its disappearing-message app, even as it has rebranded itself as a "camera" company making video recording glasses and tools.

Snap's IPO also is seen as a test for big mutual fund firms, traditionally some of the largest buyers of tech IPOs. The companies lately have made shareholder rights a rallying cry and some governance specialists have called for funds to avoid the IPO because of the unusual voting situation.

Schacht said Snap declined an invitation to appear at the March 9 meeting. He said the discussion will also explore the company's viewpoint on governance and the argument its voting structure could be cheaper than for a company with traditional voting rights.

"We'll try to explore both sides. Is this is a slap in the face of corporate governance, or is this the market efficiency of the future?," he said.