By Matthew Miller and Julie Zhu

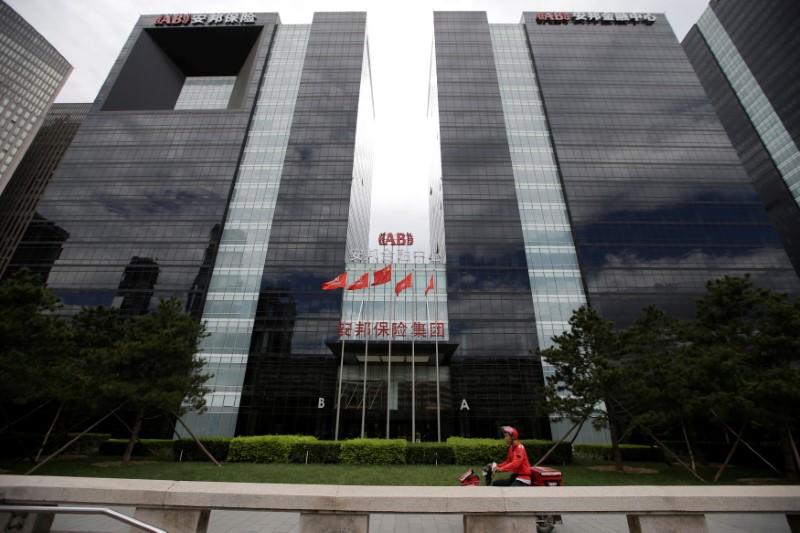

BEIJING/HONG KONG (Reuters) - China's Anbang Insurance Group, whose chairman was detained late last week, said on Thursday that its products were still being sold through banks, although employees at some lenders said they had stopped selling them, in some cases months ago.

A spokesman for the acquisitive insurance giant, which made headlines with its 2015 purchase of New York's Waldorf Astoria hotel, said banks were still distributing its products. Bloomberg earlier reported that Chinese authorities had asked lenders to suspend some business dealings with Anbang.

That report cited an unnamed source and did not give details on what type of business dealings with Anbang banks were asked to suspend.

China's banking regulator did not immediately respond to a faxed request for comment from Reuters.

Anbang, one of China's most aggressive buyers of overseas assets, said early on Wednesday that Chairman Wu Xiaohui was temporarily unable to fulfil his duties. Last week, the company denied reports that Wu had been barred from leaving China.

Wu was detained by authorities last Friday, people familiar with the matter said. None of the sources wanted to be identified given the sensitivity of the matter. Two days earlier, Wu had presided over a large internal meeting that appeared to be business as usual, said a person who was there.

Anbang, which said it is operating normally in Wu's absence, distributes insurance through multiple channel types. According to its annual report, 88 percent of its insurance sales last year were through banks.

The insurer has spent more than $30 billion in the past two years acquiring insurers, luxury hotels and other property assets. But it has faced increasing pushback in its offshore deal-making amid a broader decline in Chinese outbound acquisitions. Beijing has strengthened curbs over capital outflows after China's leadership vowed to curb risk in its financial system.

INDUSTRY SCRUTINY

China's big insurers have attracted regulatory attention for their aggressive acquisitions of overseas assets, while using client money derived from high-yield investment products sold to consumers. This has particularly jarred with authorities concerned about an economy over-reliant on credit.

In a speech late last year, China Securities Regulatory Commission (CSRC) Chairman Liu Shiyu criticised the prevalence of "abnormal" highly-leveraged acquisitions by insurers and other financial companies, and that in some instances, their use of funds of "improper origins" represented the "retrogression and decay" of human nature and business ethics.

In April, President Xi Jinping ordered more to be done to rid Chinese financial firms of excessive risk.

Zhuang Deshui, deputy director at Peking University's Clean Government Centre, said the anti-corruption crackdown directed at the financial industry was aimed at breaking up vested interest groups, including Communist Party officials, who had abused their power for financial gain while obstructing key reforms.

'SOLD OUT'

Employees at several Chinese banks contacted by Reuters on Thursday said they had stopped selling some Anbang products, in some cases several months ago and also because the products had "sold out".

The head of a Beijing branch of Industrial and Commercial Bank of China (ICBC) (SS:601398) said Anbang's 3-year universal insurance products with guaranteed principal and interest were very popular last year, with interest rates at 3-4 percent.

But since receiving a notice from its headquarters in the third quarter of 2016, it had stopped selling Anbang products, the bank official said, adding that reasons behind the suspension were not disclosed.

A sales representative at a sub-branch of CITIC Bank (SS:601998) in the eastern city of Hangzhou said sales of nearly all Anbang products had been suspended since late May. Only a 5-year insurance product with a relatively low yield of more than 4 percent was being sold, the agent said.

ICBC and CITIC Bank did not immediately respond to requests for comment.

The head of a Beijing branch of Bank of Hangzhou (SS:600926) said it had not received any notice on suspending sales of Anbang products, which were still for sale. The bank did not immediately reply to a request for comment.

Last month, Anbang Life Insurance was barred from issuing new products for three months for "disrupting market order" by designing a product that bypassed regulations aimed at curbing growth in risky, short-term, universal life insurance products.

Anbang Life at the start of the year had begun to shift its sales away from universal life to traditional products, generating premiums in the first quarter that topped full-year 2016 totals.

Anbang has 1.97 trillion yuan ($290 billion)in assets, according to its website.