Benzinga - by Piero Cingari, Benzinga Staff Writer.

European stocks embarked on a vigorous rally following the European Central Bank’s (ECB) latest interest-rate announcement on Thursday. The ECB took a significant step by raising interest rates for the tenth consecutive time, pushing the main refinancing operations rate to a 22-year high of 4.5%, while the deposit facility rate reached a new record at 4%.

However, the Frankfurt-based institution’s statement delivered a surprising twist. It signaled that the current interest rate levels might be sufficient to bring inflation back to its target.

Additionally, the ECB revised down its estimates for both underlying inflation and growth.

David Goebel, associate director of investment strategy at wealth manager Evelyn Partners, remarked that this could be the last move in their current hiking cycle. Peter Praet, the former ECB Chief Economist, who now serves as a member of Market News’s Connect Advisory Board, indicated that rate cuts might be on the table for discussion as early as the December Policy meeting.

The market’s interpretation of the ECB statement and Governor Lagarde’s press conference was clear: the ECB might have reached the end of its interest rate hiking cycle, which had commenced in July 2022.

This revelation had an immediate impact on the currency market, as the euro experienced downward pressure. The euro-dollar exchange rate dipped below 1.07, hitting lows not seen since mid-March.

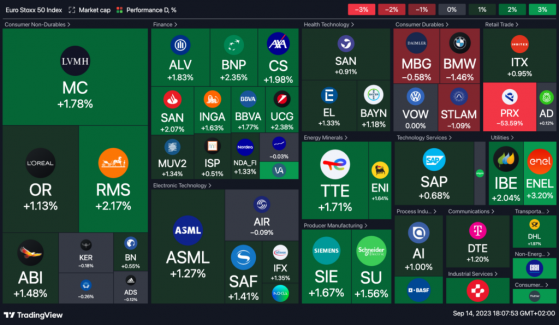

Conversely, the stock market was a sea of green, with relief sweeping through investors who believed that the cost of borrowing would not rise further from its current levels.

European Indices Rally As ECB Tightening Ends

- The pan-european Euro Stoxx 50 index, as tracked by SPDR DJ Euro STOXX 50 ETF (NYSE:FEZ), surged 1.6% marking its most robust session in September.

- The UK FTSE 100 Index, monitored through iShares MSCI United Kingdom ETF (NYSE:EWU), rallied an impressive 2.2%, poised to achieve its best session since early November 2022.

- Italy’s FTSE MIB index, tracked by the iShares MSCI Italy ETF (NYSE:EWI), climbed 1.5%, registering its best session since the end of July 2023.

- The French CAC 40 Index, as reflected by the iShares MSCI France ETF (NYSE:EWQ), recorded a 1.6% gain, its most significant daily increase since early May 2023.

- The Germany DAX 30 Index, monitored through the iShares MSCI Germany Index Fund (NYSE:EWG), posted a respectable 1.2% gain.

Positive economic news from both the United States and China added fuel to the fire. Retail sales in the U.S. surpassed expectations for August, while Chinese authorities reduced the reserve requirement ratio to enhance liquidity in the banking sector.

This news gave an additional boost to European companies that heavily rely on exports. The luxury sector rallied, with the heavyweight LVMH-Moet Hennessy Louis Vuitton (OTCPK: LVMHF) surging by 2.2%. European banks also saw significant gains, with French giant BNP Paribas (OTCPK: BNPQY) leading the pack with a 3.2% increase.

In the United Kingdom, materials and energy stocks were the driving force behind the stock market’s ascent. Anglo American plc (OTCPK: NGLOY) recorded an impressive gain of over 8%, while Rio Tinto plc (NYSE:RIO) came close with nearly a 5% increase.

Read now: Inflation Surges, Consumer Demand Ignites Reflation Trade: Top 5 ETFs Dominating Thursday’s Market

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.