By Peter Nurse

Investing.com - European stock markets traded largely higher Tuesday, helped by optimism that the region is finally turning the corner as its economies reopen.

At 3:50 AM ET (0850 GMT), the DAX in Germany traded 0.4% lower, while the CAC 40 in France rose 0.1% and the U.K.’s FTSE 100 climbed 0.6%, after a holiday-extended weekend.

Confidence is growing throughout Europe over its recovery from the pandemic as the rate of vaccination in EU member states rises quickly. On Monday, the European Commission put forward a plan to reopen the continent to holidaymakers from countries with low Covid infection rates, such as the U.K., and to anyone who has been fully vaccinated, by the start of June.

There is a similar note of optimism in the U.S., with many states continuing to relax pandemic restrictions amid the vaccine rollout. New York, one of the hardest hit of the U.S. states, recently announced that most mobility restrictions will soon be lifted, while 24-hour subway service will resume in New York City later this month.

The one fly in the ointment is Asia, and India in particular. The country’s second wave of Covid-19 infections shows no signs of slowing down, with the number of reported cases topping 20 million earlier Tuesday. The World Health Organization stated last week that one in every three new coronavirus cases globally is being reported in India.

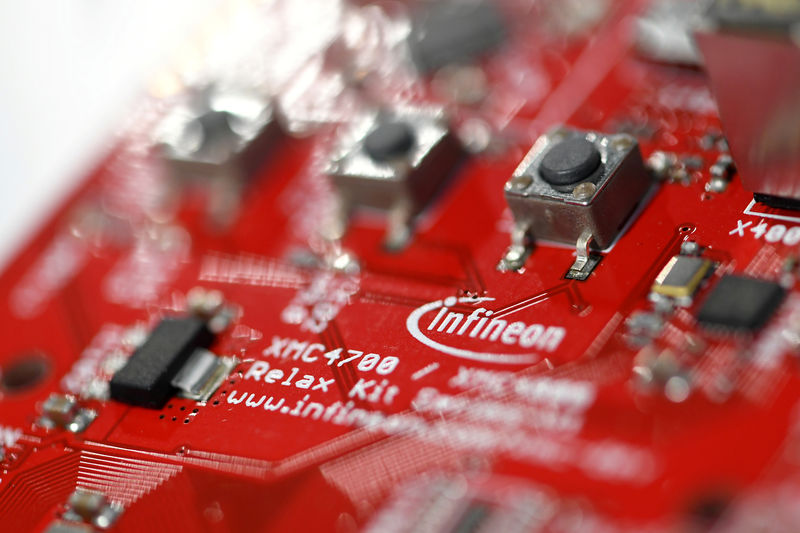

Back in Europe, Infineon (OTC:IFNNY) stock slumped 3.3%, dragging the DAX index lower, despite the German chipmaker raising its guidance for revenue and margins in the current fiscal year, with semiconductor demand booming. It noted that the outage of its manufacturing plant in Texas, which went offline after the severe winter storms in February, would continue to constrain sales growth in the current quarter. .

Telenor ASA (OL:TEL) stock fell 2% after the Norwegian telecommunications company posted a first-quarter net loss on the back of writing off the value of its Myanmar operation in light of the country's deteriorating security and human rights situation.

On a more positive note, Mediaset (OTC:MDIUY) stock rose 4.2% after the Italian broadcaster and its second-largest investor, French media group Vivendi (OTC:VIVHY), up 0.3%, signed a long-awaited agreement to end years of legal sparring over a collapsed pay-TV deal.

Dassault Aviation (PA:AVMD) stock rose 7% after Egypt's defense ministry said it had signed a contract with France to buy 30 Rafale fighter jets.

Oil prices edged higher Tuesday, with investors digesting the ever increasing number of Covid-19 cases in India but also the continued economic recovery in regions such as Europe and the U.S.

Helping the tone, Saudi Arabian state oil producer Aramco (SE:2222) beat recorded a 30% rise in first-quarter net profit and maintained its dividend payout, helped by strong oil prices.

U.S. crude oil supply data from the American Petroleum Institute, due later in the session, will be studied with interest.

U.S. crude futures traded 0.2% higher at $64.63 a barrel, while the Brent contract rose 0.3% to $67.75. Both contracts are over 30% higher so far this year.

Elsewhere, gold futures fell 0.4% to $1,785.20/oz, while EUR/USD traded 0.4% lower at 1.2014.