Proactive Investors - Ofgem’s price cap from October will allow energy suppliers to increase their profit margins even further by millions of pounds, despite rates being set to fall marginally.

Though the cap will fall from £2,047 to £1,923 for the winter months, the earnings before interest and tax allowance under the mechanism will be increased from 1.9% to 2.4%.

British Gas and Eon are among the energy suppliers to have already secured higher profits so far this year thanks to clauses in the price cap allowing them to charge more on consumer bills.

According to Ofgem, some 29 million customers are on standard variable tariffs, with the change in the cap clause allowing suppliers to charge extra on bills for each.

Overall, Ofgem said the increase would add an average of £10 to consumer bills over the course of the year.

“This will ultimately benefit consumers, as it protects them from the cost of supplier failures and enables investment to improve the quality of services,” Ofgem said.

Some 30 companies have collapsed since wholesale prices started to drastically rise in 2021, the regulator noted, with the increase aimed at ensuring a more “resilient” market.

Though the clause has already seen British Gas and Eon – two of Britain’s largest suppliers - score near-900% and 40% increases in interim profits this year, Ofgem dubbed the higher allowance as “necessary”.

End Fuel Poverty Coalition coordinator Simon Francis raised concerns over the move, pointing to reduced government support and noting that prices will still be roughly double the norm, despite falling.

“The reality is that every unit of energy a customer uses costs double what it did a few years ago,” he said.

“The energy bills support scheme has also been taken away this winter, while energy firms have been allowed to increase the profits they make per customer.

"Vulnerable households have been left wondering what will happen this winter and beyond.”

Ofgem’s cap effectively governs how much suppliers can charge per unit of energy, despite initially being designed to ensure a limit.

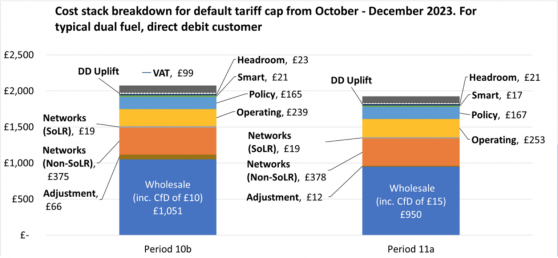

Accounting for changes in the wholesale price of energy, alongside the likes of suppliers’ operating costs and network upkeep, the cap suggests how much the average household would pay annually based on the current rates.

Source - Ofgem

From October, the cap will be priced at £1,923, which includes rates of 27.35p and 6.89p per kilowatt hour of electricity and gas respectively, alongside daily standing charges of 53.37p and 29.62p for each.