Benzinga - by Zacks, Benzinga Contributor.

Eastman Chemical Company (NYSE: EMN), which produces Naia cellulosic fibers, has formed a strategic partnership with Debrand, a well-known next-life logistics company that specializes in finding sustainable solutions to apparel waste for some of the world's leading apparel and footwear brands.

Eastman, in collaboration with Debrand, will recycle 5,000 pounds of pre- and post-consumer garment waste utilizing cutting-edge molecular recycling technology. The procedure reduces apparel waste to its molecular building blocks. It uses certified recycled material to make Naia Renew fibers, which are circular fibers made from 60% sustainably sourced wood pulp and 40% recycled waste material using a Global Recycled Standard-approved mass balance.

Eastman's partnership with Debrand enables it to further its Naia sustainability goals, particularly the mainstreaming of circularity, by developing sustainable solutions for end-of-life textiles and converting them into valuable resources for new Naia Renew fibers. This relationship demonstrates the company's commitment to working closely with major collectors and sorters to create infrastructure changes that will advance sustainability in the fashion sector.

Eastman and Debrand demonstrate the transformational power of molecular recycling technology to address the textile waste challenge. The partnership raises the bar for sustainable practices in the fashion sector by offering more circular solutions for apparel waste. Before it collaborated with Eastman, Debrand received a strategic investment from Waste Management, North America's leading provider of complete waste management, to supply circular solutions in the United States and Canada.

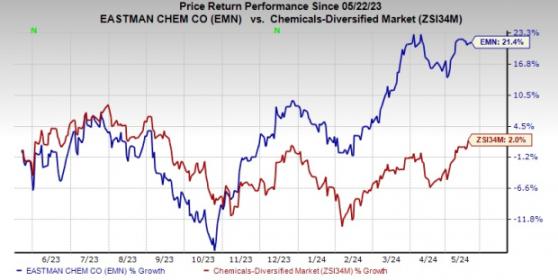

Shares of Eastman have gained 21.4% over the past year compared with a 2% rise of its industry.

Image Source: Zacks Investment Research

Eastman Chemical, on its first-quarter call, said that it predicts uncertain primary demand in key markets and regions through the remainder of 2024. However, the company continues to gain from its innovation-driven growth approach, which enables growth beyond its end markets. Eastman expects to gain from revenues and earnings generated by its Kingsport methanolysis unit, mostly in the second half of the year. The company plans to maintain pricing discipline and improve asset utilization throughout the year.

Eastman Chemical Company Price and Consensus Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Zacks Rank & Key Picks Eastman currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. (NYSE: ATI), Carpenter Technology Corporation (NYSE: CRS) and Ecolab Inc. (NYSE: ECL).

ATI carries a Zacks Rank #1 (Strong Buy) at present. ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company's shares have soared 62.3% in the past year.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company's shares have soared 128.4%% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company's shares have rallied roughly 35.6% in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga