Investing.com — Here is your Pro Recap of the upcoming major earnings reports next week: Coca-Cola, Airbnb, Cisco Systems, and Coinbase.

Coca-Cola

Coca-Cola (NYSE:KO) is set to report its Q4 earnings on Feb 13, before the market opens. Street estimates stand at $0.49 for EPS and $10.66 billion for revenues.

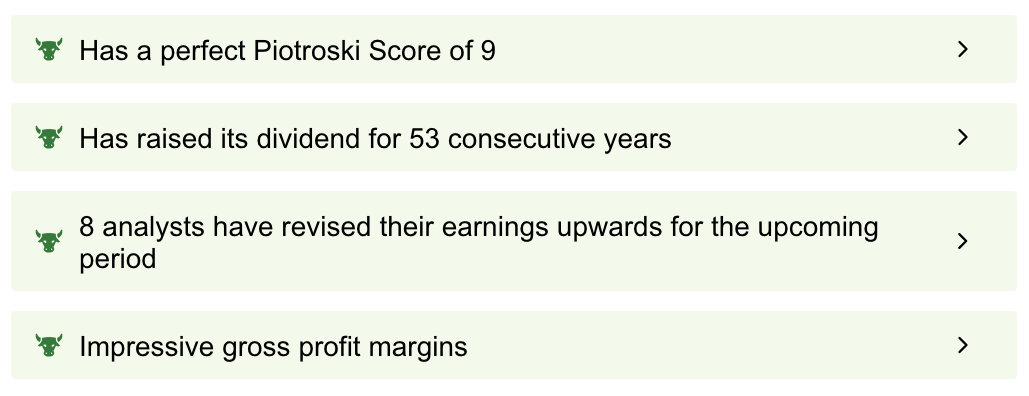

Our ProTips - exclusive to InvestingPro users - underline Coca-Cola’s strength, including 53 consecutive years of dividend raise, upward earnings revision for the upcoming period by 8 analysts, and impressive gross profit margins.

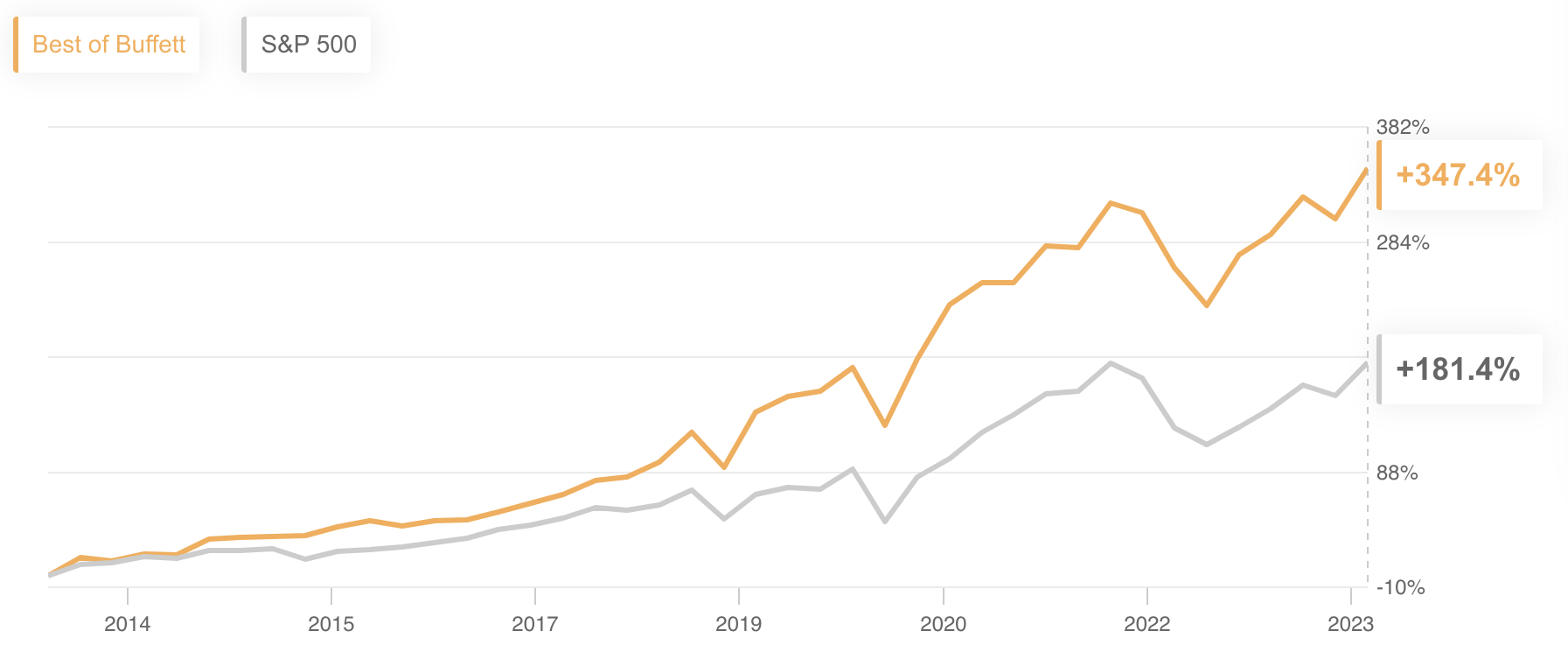

Coca-Cola has been an integral part of our ProPicks Best of Buffett strategy. Powered by advanced AI technology, this strategy outperformed the market by a lofty 174.3% over the last decade.

Want to see more market-beating picks? Subscribe here and see all our six strategies with the best selection of stocks in the market at the tip of their fingers every month.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes PROPICKS2024 and PROPICKS20242.

Airbnb

Airbnb (NASDAQ:ABNB) is anticipated to announce its Q4 earnings on Feb 13, after the market closes, with analysts forecasting an EPS of $0.65 and revenues of $2.16B.

Earlier this month, several Wall Street firms raised their price targets on Airbnb ahead of the upcoming quarterly report.

Deutsche Bank raised the price target on Airbnb to $141.00 from $105.00 while maintaining a Hold rating.

On ABNB, we raise our 4Q nights expectations given constructive data checks with AirDNA and we are now ahead of the Street by ~1%. That said, we believe that this beat is well understood at this point and look for 1Q nights in line with the Street suggesting 2 points of Y/Y growth deceleration to start the year. Beyond the 1Q outlook, we expect Airbnb to give constructive commentary on full-year margin given the benefits of cross-currency FX fees as well as a measured stance towards fixed cost growth for the year.

Meanwhile, UBS raised the price target on Airbnb to $148.00 from $125.00 while maintaining a Neutral rating.

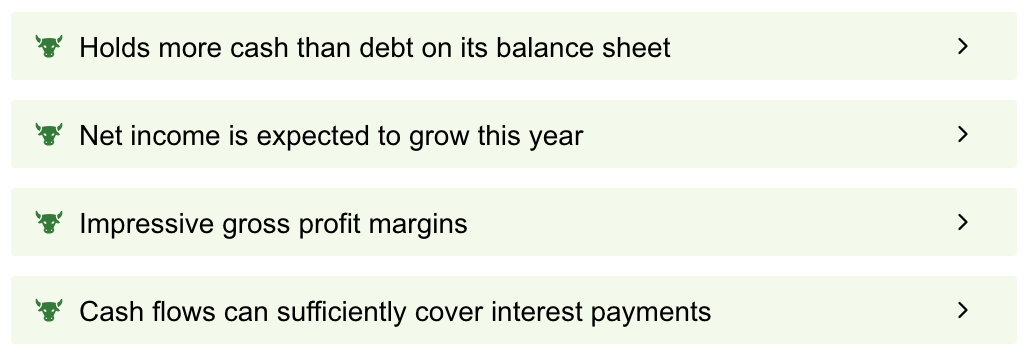

According to ProTips, the company holds more cash than debt on its balance sheet, shows impressive gross profit margins, and its net income is expected to grow this year.

Cisco Systems

Cisco Systems (NASDAQ:CSCO) is scheduled to report its Q2 earnings on Feb 14, after the market close, with consensus estimates at $0.84 for EPS and $12.71B for revenues.

Earlier this week, Evercore ISI expressed a cautious stance as Cisco approaches its earnings announcement, while still maintaining its Outperform rating and a price target of $55.00. The firm highlighted concerns due to a noticeable slowdown in the enterprise networking market, as indicated by industry peers and partners.

Near-term outlook is challenging given enterprise networking weakness, but bullish messaging around the cloud/AI opportunity could provide some support even if they report weaker numbers."

Furthermore, reports from Reuters this week indicated that Cisco is contemplating significant organizational changes, including a substantial reduction in its workforce. According to sources familiar with the matter, the digital communications giant is planning to restructure its business and seeks to let go "thousands of employees," in order to focus "high-growth areas."

Coinbase

Coinbase Global (NASDAQ:COIN) is expected to release its Q4 earnings on Feb 15, after the market closes. Wall Street consensus stands at $0.0256 for EPS and $822.32M for revenues.

The cryptocurrency exchange received mixed analyst views last month, with Oppenheimer upgrading it to Outperform based on several positive catalysts, while JPMorgan downgraded it to Underweight, citing potential disappointment from Bitcoin ETF expectations.

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, investors have the best selection of stocks in the market at the tip of their fingers every month.