Benzinga - by The Arora Report, Benzinga Contributor.

To gain an edge, this is what you need to know today.

Deploy Cash And Reduce Hedges The trigger for the call to deploy cash and reduce hedges is two-fold:

- Market mechanics of year end chase. This market mechanic results in money managers aggressively buying stocks even if their opinion of the stock market is bearish.

- Lower than expected CPI.

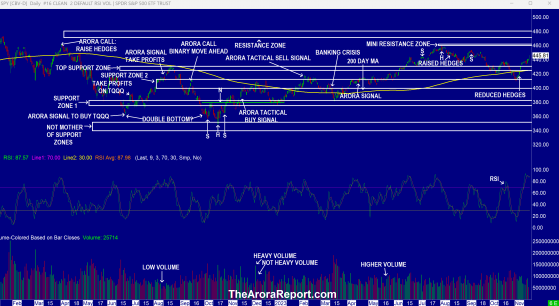

CPI Please click here for a chart of SPDR S&P 500 ETF Trust (ARCA:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows that the stock market is ripping higher this morning on better than expected CPI.

- The chart shows that the next target is the mini resistance zone.

- The chart shows when hedges were reduced previously. The prior call was to deploy more cash. Now, there is a new call to deploy more cash and reduce hedges further.

- RSI on the chart shows that the market is overbought. If the market pulls back due to overbought conditions, the pullback should be used to deploy more cash and reduce hedges.

- CPI came better than expected. Here are the details:

- Headline CPI came at 0.0% vs. 0.1% consensus.

- Core CPI came at 0.2% vs. 0.3% consensus.

- Home Depot Inc (NYSE: HD) earnings have broader implications. Home Depot is also in the Dow Jones Industrial Average (ARCA: DJIA). Home Depot reported earnings slightly better than the consensus. Prudent investors should note that Home Depot expects fiscal year earnings to be down 9% - 11% and same store sales to drop by 3% - 4%. In spite of this negative data, HD stock is being aggressively bought this morning on earnings.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is