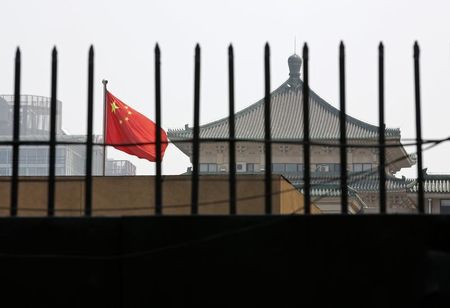

By Matthew Miller BEIJING (Reuters) - China's recent probes into Microsoft Corp (O:MSFT) and car companies including Audi and Chrysler have rekindled concerns that Beijing may be using an anti-monopoly law to support domestic firms at the expense of foreign companies.

On Wednesday, the State Administration for Industry and Commerce (SAIC) conducted its second round of raids against Microsoft, including for the first time its financial services provider Accenture Plc (N:ACN).

Another anti-trust regulator, the National Development and Reform Commission (NDRC) also said on Wednesday it would punish Volkswagen AG's (DE:VOWG_p) Audi unit and Chrysler, owned by Fiat SpA (MI:FIA), after an ongoing investigation showed they had engaged in monopoly practices.

Chinese regulators have in the past few years intensified their enforcement of the six-year-old anti-monopoly law, which stipulates fines of between 1 and 10 percent of a company's revenues for the previous year for anti-competitive practices.

In addition to the SAIC and the NDRC, the Ministry of Commerce (MOFCOM) is also tasked with enforcing the law, which is still relatively new. In some cases, officials are required to consider industrial policy.

Legal experts point out that the authorities appear to have wielded the law against more foreign multinationals than local companies. The firms targeted include Mead Johnson Nutrition Co (N:MJN) and Danone SA (PA:DANO), which the regulator slapped with hefty fines, as well as U.S. chipmaker Qualcomm Inc (O:QCOM) which faces the prospect of a $1 billion fine.

"A significant proportion of the high profile cases appear to involve big foreign firms," said Mark Williams, an anti-trust expert and professor at University of Melbourne Law School.

"Critical observers have suggested that this gives the appearance that the AML is being used to discipline new entrants to the China market." The AML is the anti-monopoly law.

In April, the U.S. Chamber of Commerce sent a private letter to Secretary of State John Kerry and Treasury Secretary Jacob Lew urging Washington to get tough with Beijing since enforcement of the anti-monopoly law was being used to pursue "China's industrial policy goals".

"It has become increasingly clear that the Chinese government has seized on using the AML to promote Chinese producer welfare and to advance industrial policies that nurture domestic enterprises, rather than the internationally accepted norm of using competition law to protect consumer welfare and competition," the letter said.

The authorities say the law is applied to both domestic and foreign firms, with the aim of protecting consumers. The NDRC has said it has targeted local telecoms companies, including China Unicom (HK:0762) and China Telecom Corp (HK:0728), and local financial institutions for anti-trust practices.

"The NDRC gives equal treatment to all market participants,"

Xu Kunlin, director general of NDRC's price supervision and anti-monopoly bureau, told Reuters recently.

"Those who have been penalized include state-owned enterprises, private companies, and foreign-owned enterprises, and industry associations," he said, adding that the law was "to protect market order and fair competition".

The NDRC's investigation into the auto industry followed domestic media complaints that foreign carmakers were overcharging Chinese customers for vehicles and spare parts. The probes spurred Audi and Mercedes-Benz, which is owned by Daimler AG (DE:DAIGn), to lower their spare part prices in China.

"Monopolistic practices are quite rampant in the auto industry. NDRC is first targeting imported luxury brands because the problem is most severe in this area," said Yale Zhang, managing director of consultancy Automotive Foresight (Shanghai) Co. Ltd.

(Editing by Miral Fahmy)