Benzinga - by Callum Thomas, Benzinga Contributor. Space ETFs: as a matter of personal interest, but also of topical interest given the recent rise of the commercial space sector (not to mention increasing interest/news around UAP!), I thought it would be worth keeping tabs on the flow of investment (or underinvestment as it turns out) into space-related ETFs.

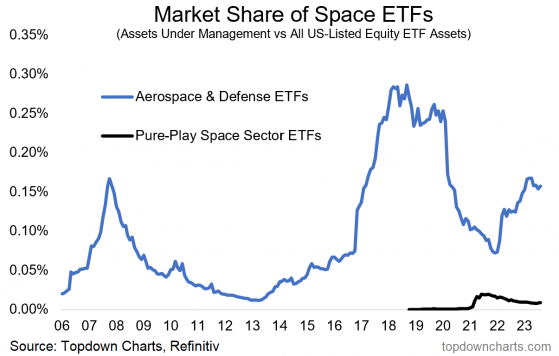

- Currently, pure-play space ETFs (which tend to hold more of the NewSpace companies like RocketLab, Virgin Galactic, et al (albeit, do NOT hold the much larger and unlisted/private SpaceX)) — such as US listed ETFs UFO (NASDAQ: UFO), ROKT (ARCA: ROKT), ARKX (BATS: ARKX) and UK listed funds JEDI, YODA, SSIT — account for about 0.01% of all US-listed Equity ETF assets under management.

- The broader and more diverse Aerospace & Defense category (which includes legacy space stalwarts (e.g. Boeing (NYSE: BA), Lockheed Martin (NYSE: LMT), et al) the likes of which were involved all the way back during the moon landings) is a bit bigger, with ETFs such as FITE (ARCA: FITE), XAR (ARCA: XAR), MISL (ARCA: MISL), ITA (BATS: ITA), PPA (ARCA: PPA) as a group accounting for 0.17% of US-listed equity ETF AUM.

- Where I think this gets interesting is firstly, the market share or implied allocation to Aerospace & Defense of 0.17% compares to a market cap weighting of 1.6% for that sector (about a 10x difference, which suggests ETF investors are massively underinvested).

- Meanwhile, on the Pure-Play/NewSpace sector, it’s anyone’s guess as to how big that will get over time (could easily one day become the largest sector on the stockmarket when you consider future potential for space-based manufacturing and mining, mars/moon colonies, orbital habitats, etc). So while most investors don’t appear to be giving it much thought right now, I think space-investing is worth keeping on the radar.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga