Benzinga - by Zacks, Benzinga Contributor.

Newell Brands Inc. (NASDAQ: NWL) has been witnessing excellent progress on its five major operational and financial priorities. In the recent quarter, the company successfully operationalized its new operating model and continues to execute its strategy, which focuses on investing in innovation, brand building, and go-to-market excellence in its largest and most profitable brands and markets.

NWL is gaining from its productivity and pricing actions, which aided margin expansions in first-quarter 2024. It witnessed normalized gross margin expansion of 410 basis points (bps) year over year to 31.2%, marking the third consecutive quarter of expansion. The normalized operating margin increased 220 bps year over year to 4.6%, while normalized EBITDA rose more than 30%.

The company has been experiencing stronger cross-functional partnerships leading to more agile and efficient decision-making, and streamlined ways of working. These enhancements are essential for NWL's transition into a high-performing, innovative and inclusive organization.

Let's Dig Deeper Newell Brands is actively boosting its productivity and efficiency through productivity plans, automation initiatives and the full implementation of Project Ovid. Additionally, it is exploring opportunities to optimize the category mix within each business unit. Its Project Phoenix, which aims at reducing overhead costs and streamlining the operating model, bodes well.

With a focus on reducing overhead costs, streamlining the operating model and centralizing supply-chain functions, Newell Brands aims to increase efficiencies. The company has initiated Project Phoenix to simplify operations, strengthen its foundation and optimize costs.

Management is making significant strides toward strengthening its front-end commercial capabilities and bringing consumer-driven innovation to market. Additionally, the new business development team is gaining momentum and the international business is surpassing North America in performance.

This business development team, launched in the United States last year, is successfully increasing distribution by attracting new customers and diversifying product offerings within existing customer relationships. The distribution gains were noted across several brands like Groco, Rubbermaid Brilliance, Calphalon, Commercial cleaning products, NUK Baby Care and many more.

Roadblocks to Address NWL has been facing a tough macroeconomic environment, characterized by core inflation, which resulted in subdued demand for discretionary and durable goods. The company has been experiencing a slowdown in retail sales amid rising inflation in essential items such as food, energy and housing. These economic conditions, coupled with the rollback of government stimulus spending, are expected to negatively impact discretionary purchases.

In first-quarter 2024, these trends led to a year-over-year net sales decline of 8.4%. Also, normalization in category trends, tight inventory management and the unfavorable impact of the bankruptcy of Bed Bath & Beyond acted as deterrents.

Moreover, there is an ongoing concern about the normalization of demand in home-based categories, which have been under pressure. Adverse foreign currency translations, particularly due to hyperinflation in Argentina, are further challenging the company's performance. This environment underscores the complexity and volatility NWL must navigate. These hurdles cannot be ignored in the near term.

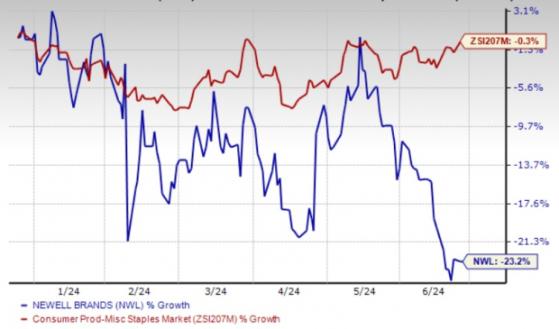

The Zacks Consensus estimate for current fiscal-year earnings per share indicates a decline of 24% from the year-earlier levels to 60 cents. Apart from this, this Zacks Rank #3 (Hold) stock has fallen 23.2% in the past six months compared with the industry's decline of 0.3%.

Image Source: Zacks Investment Research

3 Picks You Can't Miss Here, we have highlighted three better-ranked stocks, namely, Vital Farms, Vita Coco Company (NASDAQ: COCO) and Ollie's Bargain Outlet (NASDAQ: OLLI).

Vital Farms offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%.

The Zacks Consensus Estimate for Vital Farms' current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Vita Coco, which develops, markets and distributes coconut water products, currently flaunts a Zacks Rank #1. COCO has a trailing four-quarter earnings surprise of 25.3%, on average.

The Zacks Consensus Estimate for Vita Coco's current financial-year sales and earnings implies an improvement of 3.5% and 40.5%, respectively, from the prior-year actuals.

Ollie's Bargain, the extreme-value retailer of brand-name merchandise, currently carries a Zacks Rank #2 (Buy). OLLI has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for Ollie's Bargain's current financial-year sales and earnings indicates a rise of around 7.9% and 11.7%, respectively, from the year-earlier levels.

To read this article on Zacks.com click here.

Read the original article on Benzinga