Benzinga - by Anusuya Lahiri, Benzinga Editor.

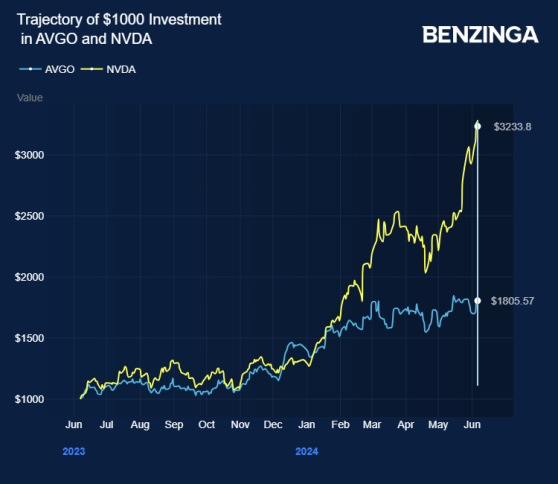

Key custom chip (ASIC) market player Broadcom Inc (NASDAQ:AVGO) has gained over 77% in the last 12 months thanks to the generative AI frenzy.

The chipmaker now has a market cap of roughly $655 billion.

According to JPMorgan analyst Harlan Sur, Broadcom remains the global No. 2 AI semiconductor supplier behind Nvidia Corp (NASDAQ:NVDA). The analyst reiterated an Overweight rating on Broadcom with a price target of $1,700.

It is the top market share leader with ~55-60% share in custom (ASIC) chip designs. As per the analyst, the market has a $20 billion — $30 billion market opportunity growing at a 20%+ CAGR.

Also Read: AMD, TSMC, Broadcom And Other Chip Stocks Hit By Biden’s Fresh AI Chip Export Restrictions – Details

Deals With Alphabet, Meta Broadcom expects $11 billion in AI-related revenues for 2024, backed by Google and Meta Platforms Inc (NASDAQ:META).

So far, it won a deal with Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google’s AI chip, the TPU v7. It also inked an agreement with Meta Platforms Inc’s (NASDAQ:META) third-generation AI chip (MTIA 3).

As per Sur, the Google TPU program has the potential to generate over $8 billion in revenues for Broadcom in 2024 (up 125% year-on-year) and over $10 billion in 2025.

The analyst noted that the new TPUv7 (first design win at 3-nm, second design win at 2-nm) win is due for monetization in calendar years 2026 and 2027.

Meta tapped Broadcom to co-design Meta’s first — and second-generation AI training processors at 7-nm and 5-nm (called MTIA), as per Sur.

Broadcom is on track to ramp Meta’s third-generation AI ASIC chip (MTIA 3 at 3-nm) in the second half of 2024 and into calendar year 2025, Sur says.

Broadcom has already won the follow-on 3-nm program targeted for calendar year 2026 ramp-up as per the analyst.

According to the analyst, Broadcom will likely drive $11 billion — $12 billion+ in total AI revenues in 2024 and $14 billion—$15 billion+ in 2025.

Analysts have claimed upside for Broadcom fueled by U.S. Big Tech giants’ focus on custom ASIC solutions for their AI compute accelerators.

Reports claimed key contract chipmaker Taiwan Semiconductor Manufacturing Co’s (NYSE:TSM) plans to boost prices of its services. That can affect the margins of its customers, including Broadcom.

Investors can gain exposure to Broadcom via Amplify ETF Trust Amplify Cybersecurity ETF (NYSE:HACK) and Pacer Funds Pacer Data And Digital Revolution ETF (NYSE:TRFK).

Price Action: AVGO shares traded lower by 0.54% at $1,405.49 at the last check Thursday.

Image: Shutterstock

Latest Ratings for AVGO

| Mar 2022 | Truist Securities | Maintains | Buy | |

| Mar 2022 | JP Morgan | Maintains | Overweight | |

| Mar 2022 | Morgan Stanley | Maintains | Overweight |

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga