(Reuters) - Alibaba Group Holding Ltd's financial services affiliate is planning an initial public offering that could take place next year, Bloomberg reported.

Zhejiang Ant Small & Micro Financial Services Group, which contains Alibaba's Alipay payment processing and financial services arm, has an estimated value of about $50 billion (33.16 billion pounds), Bloomberg reported, citing people familiar with the matter.

"Ant Financial is weighing a private placement before going public, and the details of the planned fundraising aren't finalised," Bloomberg said.

Alibaba spokeswoman Teresa Li, speaking on behalf of both Alibaba and Ant Financial, declined to comment on the report.

A source close to Alibaba said there was no timetable yet for the IPO.

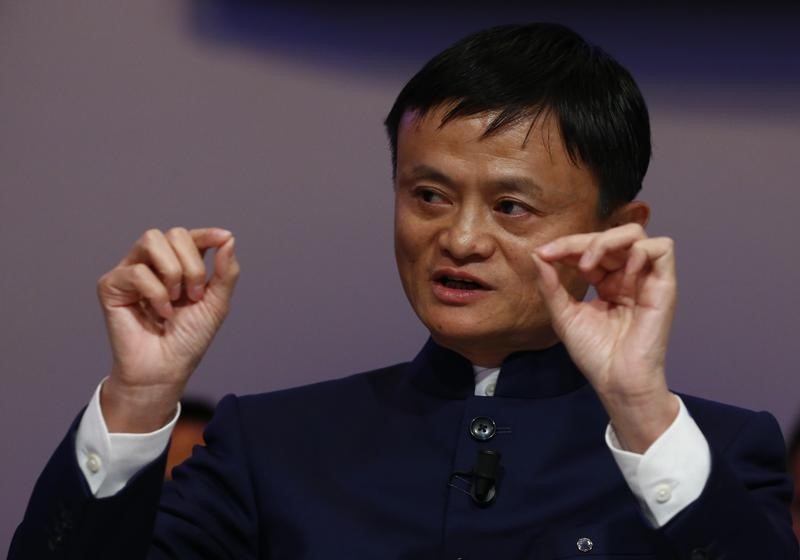

In November, Alibaba Group Executive Chairman Jack Ma said Ant Financial, which is not part of the New York-listed company, will definitely seek a separate listing, ideally on a domestic stock market.

Set up in 2014, Ant Financial has been growing rapidly, largely through targeting smaller businesses and hundreds of millions of consumers who are often underserved by China's larger banks. Its services include payment processing, personal banking, wealth management, small business loans, personal credit and insurance.

Alibaba has been using its dominant market position in e-commerce to push into the financial services market. The firm's efforts include a money market fund for consumers, a mobile payment app and a private bank.