By James Regan

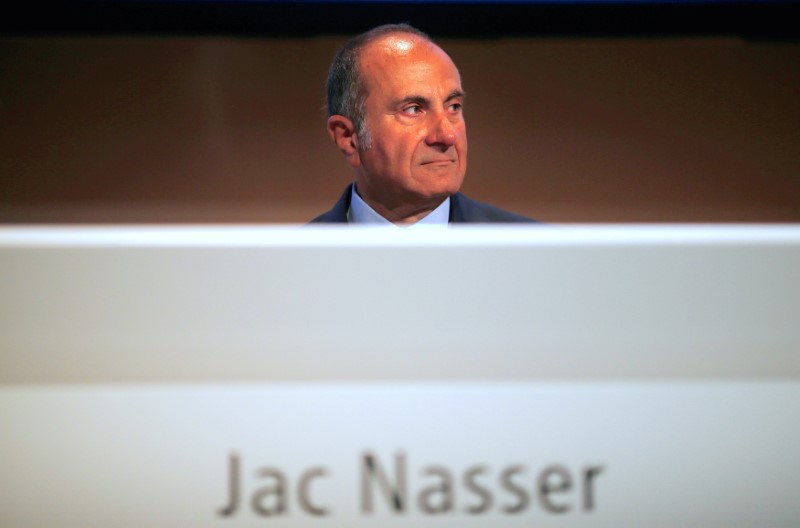

SYDNEY (Reuters) - BHP Billiton's (AX:BHP) (L:BLT) Chairman Jac Nasser said on Thursday BHP's $20 billion (15.43 billion pounds) investment in U.S. shale oil and gas six years ago was, in hindsight, a mistake.

BHP entered the shale business at the height of the fracking boom in 2011 and invested billions more developing the operations. The fall in oil prices since then has led to pre-tax writedowns of about $13 billion on the business.

Activist shareholder and hedge fund Elliott Management, holding 4.1 percent of BHP's London-listed shares, has been trying to gain support from other shareholders to persuade BHP to sell the shale oil and gas business.

"If you had to turn the clock back, and if we knew what we knew today, we wouldn't do it, of course we wouldn't do it, but go back and put yourself in our position at that time," Nasser told a business seminar, referring to the shale purchase.

"We bought exactly what we thought we were buying, but the timing was way off."

New York-based Elliott has directed a barrage of criticism at the global miner since releasing a list of changes in April it wants the company to implement. [nL3N1HI3HI]

Its list includes an exit from shale, removal of BHP's dual London and Australian stock listings and greater emphasis on shareholder returns. Nasser would not comment on Elliott's proposal. But he defended BHP's performance, saying the company's shareholder returns were up 486 percent since BHP merged with Billiton Plc in 2001.

BHP Chief Executive Andrew Mackenzie told a conference in May the company was considering divesting some shale acreage, although it believed the assets were "well-placed for the future."

Australian wealth management group Escala and fund Tribeca Investment Partners have also campaigned for a revamp at BHP, calling for board changes and reviews of the energy operations. Nasser, a former head of Ford Motor Co . (N:F) is scheduled to retire as chairman on Sept. 1. The appointment of Nasser's successor, Ken MacKenzie, a former packaging industry executive, has been welcomed by Elliott as a "constructive step in bringing much needed change to the direction of BHP."