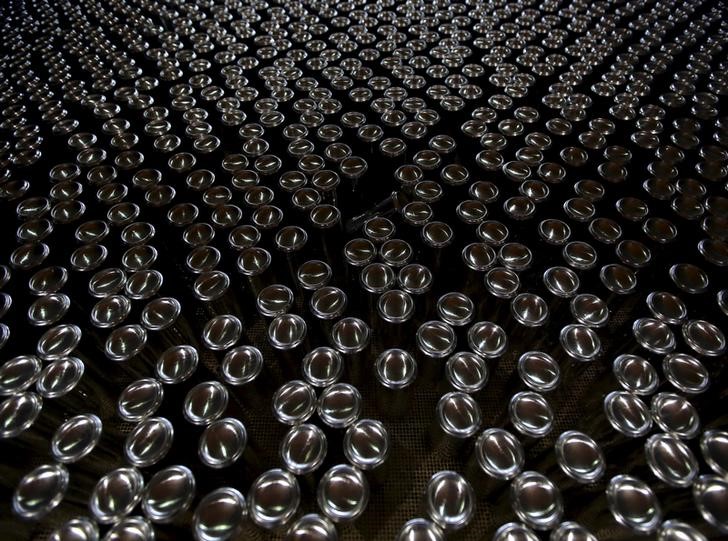

(Reuters) - Beverage can makers Ball Corp (N:BLL) and Rexam Plc (L:REX) will sell some of their assets to European packaging maker Ardagh Group [ARDGR.UL] in a deal worth $3.42 billion, as they seek antitrust clearance for their planned merger.

The deal would include the sale of about a fifth of the companies' combined can making or producing plants across Europe, Brazil and the United States, Ball said in a statement on Monday.

The companies will also sell certain innovation and support functions in these regions, Ball said, which would put it on track to close the Rexam deal by the end of June.

Ball agreed to buy British rival Rexam for 4.43 billion pounds last year to improve efficiency and cut costs through a merger of the world's two largest beverage can makers by volume, which supply Coca-Cola Co (N:KO) and Anheuser-Busch InBev (BR:ABI).

However, the deal earlier ran foul with European antitrust regulators as it would give the enlarged entity considerable market share in Europe, the United States and Brazil.

The two companies account for 60 percent of beverage can supply in North America, 69 percent in Europe and 74 percent in Brazil, according to Morningstar analysts.

The European Commission cleared the deal in January, subject to the divestment of 12 plants.

The divestment to Ardagh includes 12 plants in Europe, eight in the United States and two in Brazil. After the deal closes, Ball will have 75 metal can manufacturing facilities and joint ventures.

The assets being sold accounted for $3 billion (2.07 billion pounds) of sales and around $375 million of core earnings in 2015, Ball said.

Reuters reported in March that Ardagh, the packaging conglomerate controlled by Irish billionaire Paul Coulson, was preparing an offer.

Ardagh said separately that the deal would make it the third largest beverage can maker globally, giving it access to a market that complements its core glass and metal container supply business.

Luxemburg-based Ardagh will pay $3.21 billion in cash under the deal that includes assumed liabilities of $210 million.

The firm launched a bond offering of $2.85 billion to partly fund the acquisition, which is its most significant since it bought the U.S. jar unit of France's Saint-Gobain (PA:SGOB) in 2013.

Ardagh said after the deal it would operate 110 facilities and have global sales of over $8.8 billion.

Rexam shares were up 0.5 percent at 639 pence at 0900 GMT.