Benzinga - by Zacks, Benzinga Contributor.

AutoZone Inc. (NYSE: AZO) reported earnings of $36.69 per share for third-quarter fiscal 2024 (ended May 4, 2024), up 7.5% year over year. Earnings surpassed the Zacks Consensus Estimate of $35.72 per share. Net sales grew 3.5% year over year to $4,235.5 million. The top line marginally missed the Zacks Consensus Estimate of $4,292 million.

In the reported quarter, domestic commercial sales totaled $1.14 billion, up from $1.11 billion recorded in the year-ago period. Domestic same-store sales (sales at stores open at least for a year) were flat.

Gross profit increased to $2.26 billion from the prior-year quarter's $2.14 billion. Operating profit increased 4.8% year over year to $900 million.

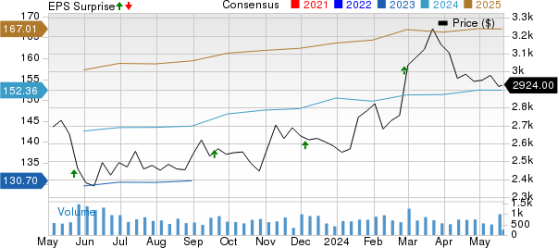

AutoZone, Inc. Price, Consensus and EPS Surprise

AutoZone, Inc. price-consensus-eps-surprise-chart | AutoZone, Inc. Quote

Store Opening & Inventory During the quarter, AutoZone opened 32 new stores in the United States. It opened 12 new stores in Mexico and one in Brazil. It exited the quarter with 6,364 stores in the United States, 763 in Mexico and 109 in Brazil. The total store count was 7,236 as of May 4, 2024.

Its inventory increased 8% year over year in the reported quarter. At quarter-end, the inventory per store was $851,000 compared with $810,000 a year ago.

Financials and Share Repurchases As of May 4, 2024, AutoZone had cash and cash equivalents of $275.4 million, down from $277.1 million as of Aug 26, 2023. Its total debt amounted to $8.5 billion as of May 4, 2024, compared with $7.67 billion as of Aug 26, 2023.

The company repurchased 242,000 shares of its common stock for $737.7 million during the fiscal third quarter at an average price of $3,036 per share. At quarter-end, it had $1.4 billion remaining under its current share repurchase authorization.

Zacks Rank & Key Picks Autozone currently carries a Zacks Rank #3 (Hold). A few better-ranked players in the auto sector are Blue Bird Corp. (NASDAQ: BLBD), Oshkosh Corp. (NYSE: OSK) and Ford (NYSE: F).

The Zacks Consensus Estimate for BLBD's fiscal 2024 earnings and sales implies year-over-year growth of 155% and 17.3%, respectively. The consensus mark for Blue Bird's 2024 and 2025 EPS has moved north by 63 cents and 69 cents, respectively, over the past 30 days. This school bus manufacturer currently sports a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Oshkosh's 2024 earnings and sales implies a year-over-year growth of 11% and 10%, respectively. The consensus mark for OSK's 2024 and 2025 EPS has moved north by 72 cents and 67 cents, respectively, over the past 30 days. This automotive equipment supplier currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for F's 2024 sales implies year-over-year growth of 3%. The consensus mark for Ford's 2024 and 2025 EPS has moved north by 7 cents each over the past 30 days. This legacy automaker currently carries a Zacks Rank #2 (Buy).

To read this article on Zacks.com click here.

Read the original article on Benzinga