Benzinga - by Piero Cingari, Benzinga Staff Writer.

Inflation will be front and center next week with a highly anticipated economic report due ahead of the upcoming Federal Reserve policy meeting scheduled for Sept. 23.

The August consumer price index report from the Bureau of Labor Statistics is set to be released Wednesday.

The prevailing consensus from economists paint a rather intricate picture that calls for heightened scrutiny.

August CPI Report: What Do Economists Expect?

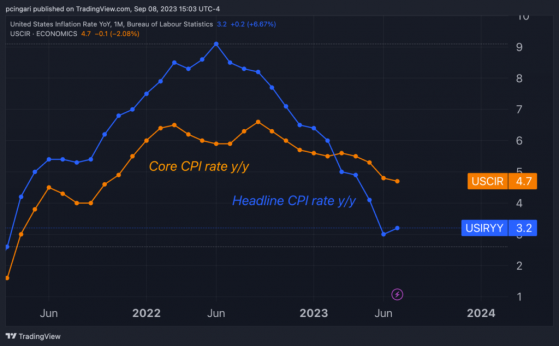

- The headline CPI is poised to make a substantial leap, expected to climb from 3.2% year-on-year in July to 3.6% in August. This would signify the second consecutive increase in the annual inflation rate.

- On a monthly basis, the CPI is projected to rise by 0.6%, a notable acceleration from the modest 0.2% uptick observed in July. If these expectations come to fruition, it would mark the most robust monthly advance in the CPI since June 2022.

- In contrast to the headline index, the core CPI, which excludes energy and food components, is anticipated to decline from July’s 4.7% year-on-year to 4.3% in August. This would push annual core inflation to its lowest levels in two years.

- On a monthly basis, the core CPI is expected to maintain the same 0.2% increase as observed in July.

Chart: US Inflation Rate, Core Inflation Rate

What’s Driving Inflation Numbers?

The culprit behind this inflation drama is energy prices, with Bank of America blaming a 5.9% surge in energy costs as the main driver for the headline increase.According to the authors of the BofA report, Stephen Juneau and Michael Gapen, evidence supporting this can be gleaned from data provided by AAA that reveals a substantial 6.6% month-on-month increase in retail gasoline prices during August.

This spike in gasoline prices reflects the broader upswing in crude oil costs, primarily instigated by supply-side dynamics.

In addition to energy, Bank of America notes a 0.2% month-on-month increase in food prices for the second consecutive month.

Investors Bet Heavily On No-Hike Outcome In September

Market sentiment is converging around the expectation that the Federal Reserve will refrain from raising interest rates in September.Market-implied probabilities, gauged through Fed futures prices, suggest a substantial 93% likelihood of the fed funds rate remaining stable within the range of 5.25% to 5.5%, according to CME Group.

For the November FOMC meeting, the market still slightly leans toward the scenario of interest rates staying put, with a 53% probability of a hold vs. a 47% chance of a rate hike.

A higher-than-expected CPI could lead to turbulence in the market as traders reassess their expectations for the future of interest rates.

On the other hand, if headline CPI falls short of expectations while the core behaves as anticipated or even better, it could provide a sigh of relief for investors, potentially boosting risk sentiment on stocks. In such a case, popular ETFs tracking major U.S. stock market indices, such as the SPDR S&P 500 ETF Trust (NYSE:SPY), the Invesco QQQ Trust (NASDAQ:QQQ) and the SPDR Dow Jones Industrial Average ETF (NYSE:DIA), are likely to positively react.

Read now: The Biggest Short: Trader Bets $30K On 1,100% VIX Spike By February 2024

Photo via Shutterstock.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga