Benzinga - by Piero Cingari, Benzinga Staff Writer.

Following the conclusion of the Apple Wonderlust event, the market’s attention is shifting to Wednesday morning, when Consumer Price Index (CPI) inflation data will be released.

According to the forecasts, this forthcoming inflation report is expected to diverge significantly from recent ones, raising concerns that have been dormant for over a year.

August Inflation Report: What Economists Are Predicting

- Economists are anticipating a substantial year-on-year surge in the overall CPI index for August, projecting a rate of 3.6%, a notable increase from the 3.2% recorded in July.

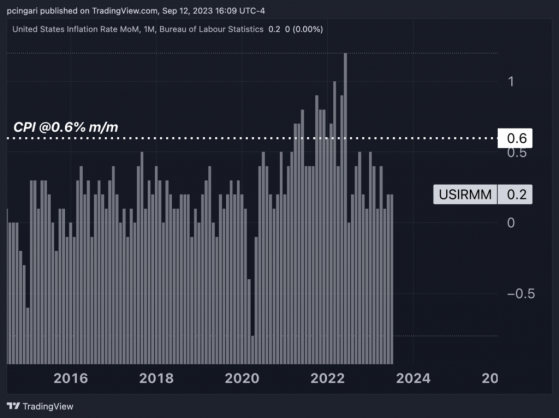

- More worrisome is the estimated monthly price pressure, which could climb to 0.6%, a substantial rise compared to the modest 0.2% observed in July. If this prediction holds true, it would mark the most significant monthly increase since June 2022.

- A spike in energy prices is to blame for the expected rise in the overall inflation rate for August.

- On a positive note, the core inflation rate, excluding energy and food components, is forecast to decrease from July’s 4.7% year-on-year to 4.3% in August.

- On a monthly basis, core inflation is expected to maintain a steady 0.2% pace, mirroring July’s figures.

- Leading up to the critical data release, market sentiment suggests a 93% probability, as indicated by Fed Futures, that the Federal Reserve will maintain unchanged interest rates during the upcoming Federal Open Market Committee Meeting.

Chart: Potential For Sizzling Monthly Surge In CPI

The Market Impact Of Monthly Inflation Reports: A Look Back

Over the last decade, there have been just 11 instances of monthly CPI readings hitting or surpassing the 0.6% threshold.These inflationary episodes occurred between April and June 2021, from October 2021 to March 2022 and again in May and June 2022.

Notably, June 2022 marked the pinnacle of the post-pandemic inflationary surge, with the CPI surging at an extraordinary month-on-month rate of 1.2%. The CPI report for June 2022 was disclosed on July 13, 2022, and it had significant effects on major asset classes, leading to the following daily changes:

- SPDR S&P 500 ETF Trust (NYSE:SPX) down 0.5%

- Invesco QQQ Trust (NASDAQ:QQQ) down 0.2%

- Dow Jones Industrial Average ETF (NYSE:DIA) down 0.7%

- SPDR Gold Trust (NYSE:GLD) up 0.5%

- US Dollar Index (DXY) down 0.1%

- iShares 20+ Year Treasury Bond ETF (NYSE:TLT) up 1.2%

Now read: Treasury Bills At 5% Yield: Retail Investors Jump On The Risk-Free Bandwagon

Photo via Shutterstock.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga