Investing.com - Here's the top 3 things that could rock markets tomorrow.

1. All Eyes on Fed

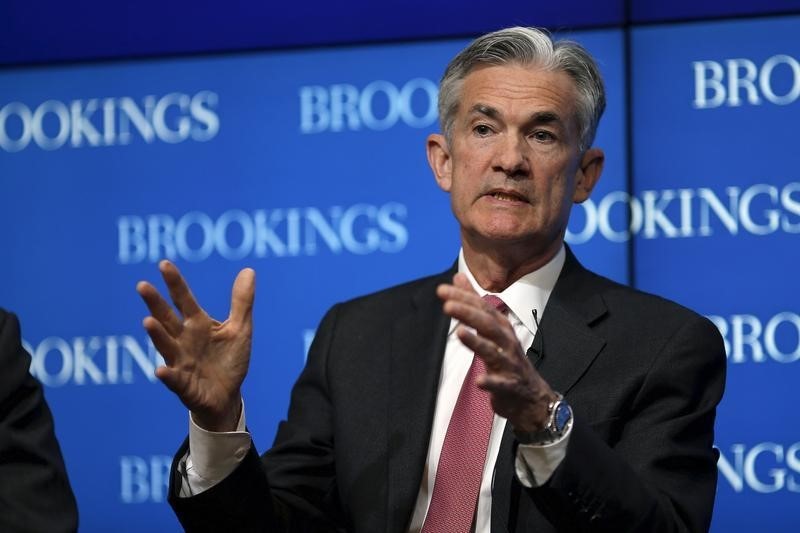

The Federal Reserve, led by Chairman Jerome Powell, takes center stage on Wednesday.

Expectations are running high that a quarter-point cut is on the menu with a good measure of dovish policy language hinting at future rate cuts.

The Federal Reserve is expected to cut its benchmark rate by 25 basis points to a range of 2.0% to 2.25% from 2.25% to 2.5%.

Investors likely will parse the Fed's policy statement and Powell's presser after the announcement for an update on the Fed's bond-buying program.

The Fed's monetary policy decision comes amid a recent string of favorable economic data, including continued consumer strength, though subdued inflation, which is below the central bank's 2% target, remains the overarching headwind for the central bank.

The Fed's policy decision comes at 2 PM ET (18:00 GMT) and will be followed Powell's news conference at 2.30 PM ET.

Today, President Donald Trump called for the Fed to come through with a "large" cut. The president has been agitating for lower rates to further stimulate the economy and also give the U.S. an edge in trade disputes by weakening the dollar.

The release of ADP’s measure of private-sector employment for July, before markets open, will also be in focus.

The report comes at 8:15 AM ET (12:15 GMT).

Economists, on average, expect that private nonfarm payrolls rose by 150,000 in July, up from a gain of 102,000 in June.

The report comes ahead of the nonfarm payrolls report due Friday from the Labor Department.

2. Apple (NASDAQ:AAPL), AMD Give Mixed Signals

There were mixed fortunes for tech from today's postmarket earnings, which could make investors even more indecisive as they wait for the Fed news.

Apple (NASDAQ:AAPL) shares rose about 4% in after-hours trading as the comapny beat on the top and bottom lines.

But chipmaker Advanced Micro Devices (NASDAQ:AMD) could weigh on other semiconductor stocks. AMD fell about 3% after hours as its revenue guidance fell short of conesnsus esimates.

General Electric (NYSE:GE) is expected to deliver second-quarter earnings before the market opens on Wednesday.

Investors will be eager for an update on the conglomerate's turnaround progress as it seeks to cut costs amid efforts to boost cash flow.

CFO Jamie Miller told investors at a conference the company expected to burn through $1 to $2 billion cash during the second quarter.

GE (NYSE:GE) is expected to report earnings of 12 cents a share on revenue of $28.48 billion, according to consensus estimates from Investing.com.

Qualcomm (NASDAQ:QCOM), meanwhile, reports fiscal third-quarter earnings after the markets close.

Qualcomm is expected to report earnings of 76 cents a share on revenue of $5.09 billion.

3. Crude Inventories on Tap

The Energy Information Administration's (EIA) weekly report on petroleum supplies is due Wednesday. The report is closely watched as a gauge for measuring oil demand and supply.

Ahead of the EIA report, the American Petroleum Institute released data, while not perfectly correlated with the EIA's report, that showed weekly crude stockpiles fell by 6 million barrels last week.

The EIA is also expected to report a draw in crude stockpiles of 2.59 million barrels for the week ended July 27, which would mark the seventh-weekly fall in crude stockpiles.

Crude oil futures rose 2% to settle at $58.05 a barrel today.