Investing.com - After breaking through the $200 barrier for the first time in its history on Tuesday, on a day that saw the share price rise by more than 7%, Apple Inc (NASDAQ:AAPL) continued its record-breaking run yesterday, closing 2.86% higher at $213.07, after setting an intraday record at $220.20.

Over the last 2 sessions, Apple shares have gained more than 10%, enabling it to move back ahead of Nvidia in the ranking of the world's largest companies by market capitalisation, trailing only Microsoft (NASDAQ:MSFT) by a very narrow margin.

- ⚠️TOOLS, TIPS and AI STRATEGIES TO SUCCEED IN THE STOCK MARKET! Join InvestingPro to equip yourself with professional tools and follow our AI-managed strategies to boost your stock portfolio and know which stocks to buy whatever the market conditions! CLICK HERE to benefit from the reader-only rate and take your investments to the next level!⚠️

Apple's current bull run began on 19 April, following a low of $164. At Wednesday's close, Apple had gained almost 30% in less than two months.

It's also worth noting that Apple's share price surge over the past two days is largely the result of excitement over a number of announcements concerning the integration of AI into its devices, which could stimulate renewal and boost sales at the Apple firm.

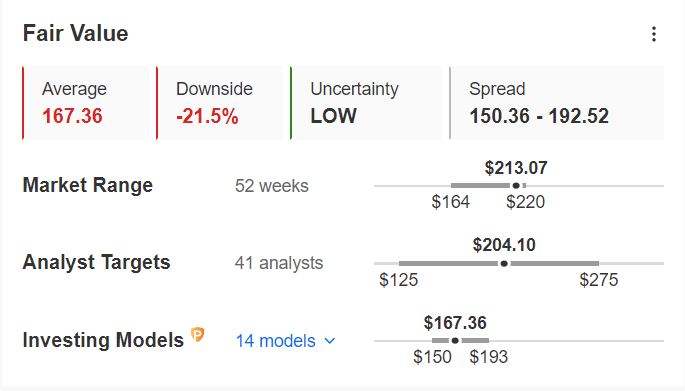

However, given the scale of the recent rise, the question arises as to whether the opportunity has already passed. On average, analysts are giving the stock a target price of $204.10, a threshold that was exceeded on Tuesday.

What's more, Fair Value, an InvestingPro proprietary indicator that synthesises several recognised financial models, values Apple at just $167.36, more than 21% below the current price.

In other words, Apple shares currently appear to be overvalued. This is also the case for many other obvious beneficiaries of AI. Nvidia is overvalued by 20% according to Fair Value, Meta (NASDAQ:META) by 7.5% and Microsoft by 11.6%.

Which stocks will rise the most in the next phase of the AI rally?

Does this mean that the AI rally is over? Probably not. On the contrary, the AI rally is likely to broaden, meaning that it will start to benefit a wider range of companies, while the big technology companies, winners in the first phase, are likely to underperform, if not correct sharply.

It would be daring to exclude large technology stocks from your portfolio altogether. However, if you want to seize the best opportunities in the next phases of the AI rally, you will need to broaden your investment horizon to include lesser-known companies with more specialised activities than the current stars of the US stock market.

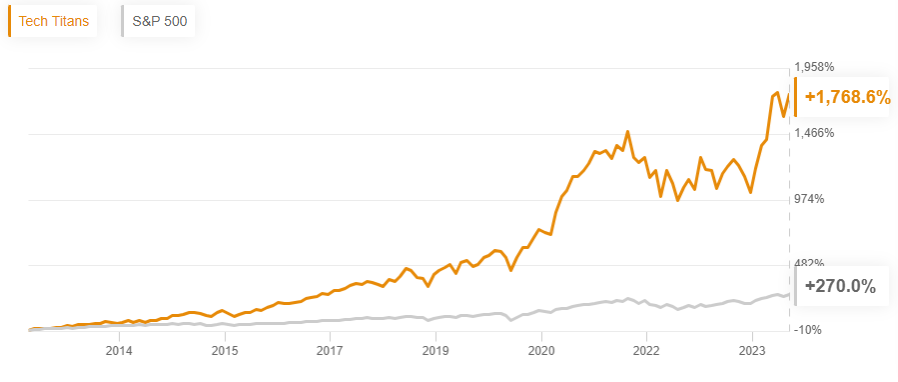

The Tech Titans strategy, one of InvestingPro's ProPicks portfolios, managed by artificial intelligence trained on InvestingPro's vast financial data, does just that.

- ⚠️TOOLS, TIPS and AI STRATEGIES TO SUCCESS IN THE STOCK MARKET! Join InvestingPro to equip yourself with professional tools and follow our AI-managed strategies to boost your stock portfolio and know which stocks to buy whatever the market conditions! CLICK HERE to benefit from the reader-only rate and take your investments to the next level!⚠️

Centred around a list of 15 stocks which are re-evaluated monthly, the Titans of Tech strategy has included the Nvidia share for several months now, for example, but also seizes numerous opportunities, sometimes in 3 figures, on lesser-known stocks.

By way of example, here are the strategy's biggest successes in May:

- Perficient: +56.39% in May

- Vistra Energy Corp: +37.08% in May

- Marathon Digital (NASDAQ:MARA) Holdings: +24.70% in May

- Applovin Corp : +18.30% in May

- NVIDIA Corporation (NASDAQ:NVDA) : +33.07% in May

- NAPCO Security Technologies: +28.88% in May

- Louisiana-Pacific Corporation: +24.88% in May

- Wayfair Inc: +17% in May

Note also that since its launch in real conditions in October 2023, the Titans of Tech strategy has posted a total gain of 65.9%.

Over the long term, on the basis of a backtest started in January 2013, the Titans of Tech strategy posted a total gain of 1768.6% at the beginning of June, i.e. 1498.6% more than the S&P 500 over the same period.

And the best part is that the Titans of Tech strategy is offered alongside 4 other thematic portfolios, which have also posted very solid performances since their launch:

- Beat the S&P 500: +28.21% in 8 months

- Outperforming the Dow Jones: +17.44% in 8 months

- Best value stocks: +34.31% in 8 months

- Midcap chart: +21.56% in 8 months

The other good news is that this super-powerful tool, which has already benefited more than 120,000 investors, is available for less than £9 per month, thanks to our reader-only offer!

- Click here to take advantage of the special discount on the 1-year Pro subscription (which comes down to £ 7 a month)

- Or click here to take out a two-year subscription at the even more attractive price of £ 6.50 per month,

Finally, it's also worth pointing out that the subscription also includes access to all InvestingPro's other features, including fair value and financial health calculations for all stocks, the advanced screener, the trading ideas section, historical financial data, and much more!

READ ALSO: