Benzinga - Apple, Inc. (NASDAQ:AAPL) recently reported better-than-expected March quarter results, and its thriving Services business was credited among the reasons for the outperformance.

Services Pack A Punch: Despite Apple being a traditional hardware company, the Services business has now grown to be its second-biggest revenue earner.

The Services business contributed a record $20.91 billion or 22.05% to the total March quarter revenue of $94.84 billion. In comparison, the iPhone, the top-revenue earning category, accounted for $51.33 billion or 54.1% of the total.

It grew by 10.5% year-over-year in the quarter, outperforming iPhone's measly 1.5% growth. All other hardware product categories saw year-over-year revenue declines.

One data that emphasizes the importance of the Services business is its margin-boosting impact. Giving a break-up of margins, CFO Luca Maestri said on the earnings call that the Services segment's margins outweighed product margin by 71% to 36.7%.

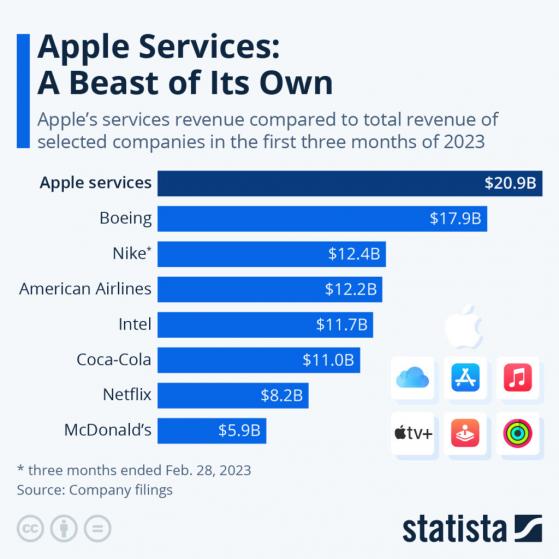

Services Topple Them All: Apple's Services business alone topped the total revenue of some high-profile Fortune 500 companies, data shared by Statista showed.

As opposed to Apple Services March quarter revenue of $20.9 billion, Boeing Co.'s (NYSE:BA) total revenue was at $17.8 billion. American Airlines Group, Inc. (NASDAQ:AAL), Intel Corp. (NYSE:INTC), Coca-Cola Co. (NYSE:KO), Netflix, Inc. (NASDAQ:NFLX) and McDonald's Corp. (NYSE:MCD) reported revenue of $12.2 billion, $11.7 billion, $11 billion, $8.2 billion and $5.9 billion, respectively, for the quarter.

Nike, Inc. (NYSE:NKE), which has a Feb. 28 end data for the quarter, ringed in revenue of $12.4 billion.

Source: Statista

Why It's Important: Apple's Services business includes iCloud, Apple Music, Apple Pay, Apple Card, App Store, Apple Arcade, Apple Podcast and a recently launched ‘Buy Now, Pay Later' service, among other things.

In the March quarter, the company noted all-time revenue records for App Store, Apple Music, iCloud and payment services. Paid subscriber count totaled more than 975 million, up 150 million over 12 months, it added.

Maestri said on the earnings call, "The continued growth in Services is the reflection of our ecosystem strength and the positive momentum we are seeing across several key metrics."

In premarket trading, Apple stock fell 0.35% to $172.90, according to Benzinga Pro data.

Read Next: If You Invested $1000 In Apple When iMac Was Unveiled 25 Years Ago, Here’s How Much You’d Have Now

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga