By Richard Leong

NEW YORK (Reuters) - For Bill Gross, quitting Pimco's $222 billion (136.67 billion pound) Total Return Fund to take over a $13 million fund at Janus Capital is like resigning the U.S. presidency to become city manager of Ashtabula, Ohio, population 18,800.

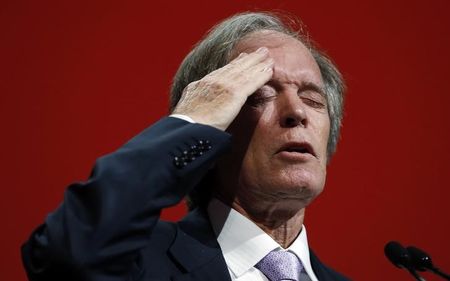

Gross stunned the investing world on Friday with his abrupt departure from Pimco, the $2 trillion asset manager he co-founded in 1971 and where he had run the Total Return Fund, the world's biggest bond fund, for more than 27 years.

Come Monday morning, Gross will join Denver-based Janus (N:JNS) and next month will take over its Unconstrained Bond Fund

"For Gross, this is a new slate albeit a small one," said Jeff Tjornehoj, senior analyst at Lipper Inc, a unit of Thomson Reuters.

Small may be overstating the Janus fund, at least in comparison with the Total Return behemoth. The relationship between the Janus Fund and the Total Return fund is the same as that of the population of Ashtabula with the population of the U.S.: 314 million.

At end of August, the Janus Unconstrained fund held only 45 debt issues with 70 percent of its assets in U.S. government debt. One Treasury issue due June 2016 <912828WQ9=> alone was worth 43 percent of the fund's total assets. Most of the bonds have short durations, with the average maturity of just over three years, indicating a generally defensive posture.

The current managers of the Janus fund are head of fixed income Gibson Smith and portfolio manager Darrell Walters. It's billed to follow a strategy of "all-weather, credit-driven fixed income investing," according to Janus' website.

By comparison, the Pimco Total Return fund holds more than 6,000 securities, ranging from plain-vanilla Treasuries to complex credit derivatives. Forty-one percent of its holdings were in U.S. government-related securities with the rest spread among riskier debt, including mortgage-backed securities and corporate bonds.

LAGGARDS

The two funds do have something in common: weak performance.

While Gross more than earned his "Bond King" moniker by outperforming rivals and the broader bond market by a wide margin for most his career, his reputation as a shrewd bond picker has taken a hit in the past year or so.

Last year, Pimco's Total Return Fund suffered its biggest annual loss in almost 20 years, declining by a wider margin than the bond market as a whole, which was buffeted by the U.S. Federal Reserve's plans to dial back on its stimulus program.

This year, it has delivered a total return so far of 3.59 percent. Still, that lags the wider market as measured by the benchmark Barclays U.S. Aggregate Bond index <.BCUSA>, which is up 4.19 percent. The fund is trailing 73 percent of its peers.

The Janus fund is doing even more poorly, however, stumbling out of the gate since its debut this spring. It lost 0.76 percent in the past three months compared with a 0.48 percent gain for the Barclays Agg, and lags 74 percent of its peers.

Getting this fund to grow will be a good measure of Gross's ability to attract money, analysts said. Gross' former Pimco colleague and Janus' chief executive Richard Weil said on Friday he'll look to Gross to build Janus' new global macro fixed income business. Until now, Janus is best remembered for its focus on technology stocks during the late 1990s dot-com boom.

"He could pull in a lot of money on reputation alone," said Tjornehoj, referring to Gross's long-term record and his widely read monthly investment newsletter at Pimco.

At Janus, Gross will also be free of the recent distractions that have beset him and his old firm.

A public falling out between Gross, 70, and former heir-apparent Mohamed El-Erian earlier this year is credited with intensifying investors' flight from the Total Return Fund. They have pulled $70 billion from the fund since last May.

On Wednesday, news surfaced that the Securities and Exchange Commission is investigating whether Pimco inflated the returns of its $3.6 billion Total Return exchange-traded fund (P:BOND).

Turning around a nascent fund might not be too tall an order, analysts said. For instance, the ETF Gross ran at Pimco had performed much better than the far-larger mutual fund, gaining 6.38 percent over the last 12 months versus 5.19 percent for the mutual fund.

Fellow bond maven Jeffrey Gundlach, head of rival firm DoubleLine Capital, often called the "King of Bonds" as opposed to Gross' nickname of "Bond King," told Reuters he expects Gross to perform well at Janus because he "isn't managing a lot of money."

Still, if the move to Janus doesn't pan out, analysts are doubtful there's room for yet another reincarnation for Gross.

"I don't know if there's a third act for him," Lipper's Tjornehoj said.

(Reporting by Richard Leong; Editing by Dan Burns and John Pickering)

2_800x533_L_1412520354.jpg)