Benzinga - by Anusuya Lahiri, Benzinga Editor.

Advanced Micro Devices, Inc (NASDAQ:AMD) claims it holds a 33% share in the server CPU market as it prepares to launch its next-gen “Turin” processors and unveils a GPU roadmap following the MI300 product line, the Register reports.

During the JP Morgan Global Technology, Media, and Communications conference, Jean Hu, AMD’s CFO, highlighted the company’s growth in servers, CPUs, and GPUs. The stock is trading higher on Tuesday.

She noted AMD’s partnerships, such as with Microsoft Corp (NASDAQ:MSFT) for virtual machine instances running AMD MI300X GPUs in Azure cloud, and AMD’s success in achieving strong double-digit growth in server CPUs and desktop/laptop segments.

Also Read: Supermicro and AMD Roll Out Multi-Node Servers To Enhance Cloud Computing

Hu emphasized that AMD’s strategic focus on power efficiency and cost-effectiveness makes it a compelling choice for enterprises facing power and space constraints. Notable clients like American Express Co (NYSE:AXP), Shell Plc (NYSE:SHEL), and STMicroelectronics N.V. (NYSE:STM) are transitioning to AMD-based infrastructure.

Hu announced plans for a next-generation AI PC to launch in the second half of the year, which could significantly refresh the PC market. She also mentioned the potential for AMD to re-enter the Arm Holdings Plc (NASDAQ:ARM) market, leveraging its existing capabilities and IP blocks to meet customer demands.

AMD sees long-term growth potential in the embedded processor market, mainly through synergies with Xilinx.

Hu also highlighted AMD’s robust performance in the desktop and laptop markets.

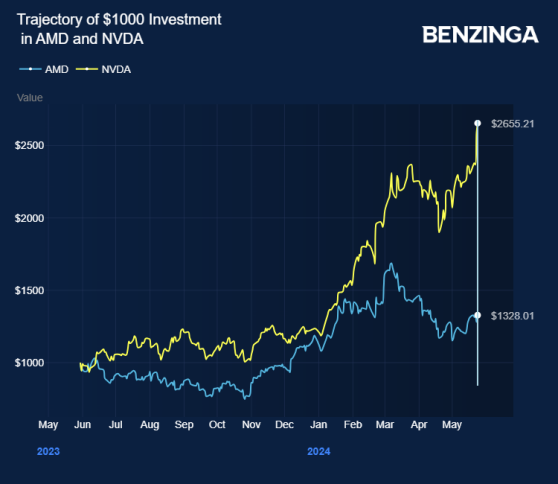

Analysts expect AMD and peers to drive semiconductor industry optimism after their earnings beat as inventory levels normalize and companies ship closer to consumption levels. However, analysts also cautioned against AMD’s MI300 supply constraints, gaming segment weakness and aggressive pricing from Nvidia Corp (NASDAQ:NVDA).

AMD stock gained 33% in the last 12 months. Investors can gain exposure to the stock via Spear Alpha ETF (NASDAQ:SPRX) and Pacer Funds Pacer Data And Digital Revolution ETF (NYSE:TRFK).

Price Actions: AMD shares traded higher by 1.87% at $169.47 premarket at the last check on Tuesday.

Also Read: AMD Unveils Cost-Effective EPYC 4004 Series CPUs For Small Businesses and IT Providers

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy of AMD

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga