The Nasdaq dipped by more than 300 points on Friday. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it indicates their concern in the company’s prospects or that they view the stock as being overpriced. Either way, this signals an opportunity to go short on the stock. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga's insider transactions platform.

Moderna (NASDAQ:MRNA)

- The Trade: Moderna, Inc. (NASDAQ: MRNA) Director Noubar B. Afeyan sold a total of 10,000 shares at an average price of $135.36. The insider received around $1.35 million from selling those shares.

- What’s Happening: Goldman Sachs (NYSE:GS) recently maintained Moderna with a Buy and raised the price target from $290 to $296.

- What Moderna Does: Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018.

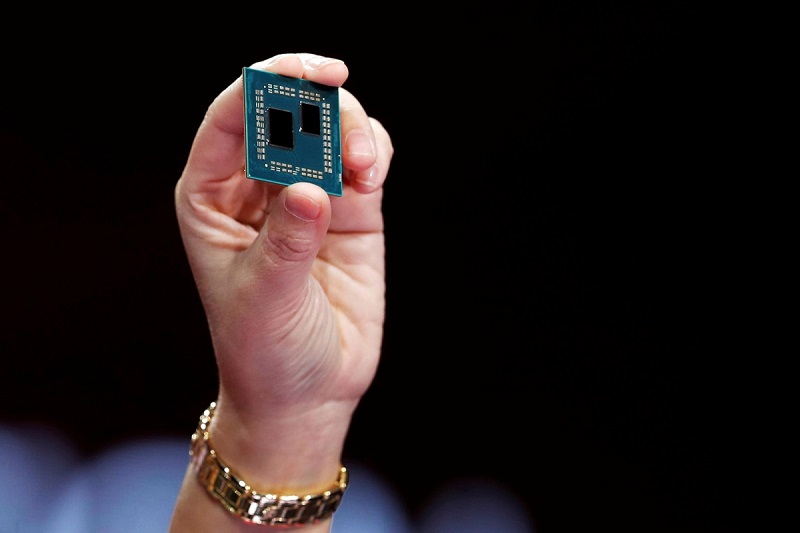

Advanced Micro Devices (NASDAQ:AMD)

- The Trade: Advanced Micro Devices, Inc. (NASDAQ: AMD) EVP and CSO Paul Darren Grasby sold a total of 10,425 shares at an average price of $57.45. The insider received around $598.92 thousand as a result of the transaction.

- What’s Happening: AMD recently collaborated with rhe Energy Sciences Network on launch of its next-generation, high-performance network to enhance data-intensive science.

- What AMD Does: Advanced Micro Devices designs microprocessors for the computer and consumer electronics industries.

- Have a look at our premarket coverage here .

- The Trade: AutoNation, Inc. (NYSE: AN) 10% owner Edward S Lampert sold a total of 31,925 shares at an average price of $105.29. The insider received around $3.36 million from selling those shares.

- What’s Happening: JP Morgan recently downgraded AutoNation from Overweight to Neutral and announced a $125 price target.

- What AutoNation Does: AutoNation is the largest automotive dealer in the United States, with 2021 revenue of $25.8 billion and about 250 dealerships at nearly 350 locations, plus 57 collision centers.

- The Trade: Airbnb, Inc. (NASDAQ: ABNB) Director Joseph Gebbia sold a total of 250,000 shares at an average price of $110.13. The insider received around $27.53 million from selling those shares.

- What’s Happening: Airbnb and Minut recently collaborated on noise prevention support for Hosts.

- What Airbnb Does: Started in 2008, Airbnb is the world's largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences.