(Bloomberg) -- China should harmonize its year-old domestic market for credit-default swaps with standards found offshore to help them become an effective and liquid tool that strengthens the bond market.

That’s the takeaway from a key global financial-industry group as international funds mull whether to take advantage of China’s increasing openness to overseas investors. A thriving CDS market would allow for hedging, but at the moment there’s little transparency. One of the country’s largest brokerages has called for setting up indexes of CDS that incorporate the bonds of multiple issuers.

Another issue is aligning onshore CDS with contracts traded offshore on Chinese bond issuers, the International Swaps and Derivatives Association says.

"One of the key barriers is the lack of ‘fungibility’ with the offshore CDS market on Chinese issuers," ISDA’s Hong Kong-based regional director for Asia Pacific Keith Noyes said in a written response to questions. "The Chinese domestic market is subject only to Chinese law and court jurisdiction, while CDS in the offshore market (including that on the Chinese sovereign) is most commonly documented under New York or U.K. law."

The recommendations come a year after Chinese authorities kicked off trading of CDS after careful consideration, given the reputation they earned during the global financial crisis. The People’s Bank of China offered no immediate response to questions on standards in the country’s CDS market.

The CDS introduction is part of a broader reform initiative in the world’s third-largest bond market. Other steps have included setting up a channel for foreign investors to buy via Hong Kong and an opening to foreign credit ratings agencies.

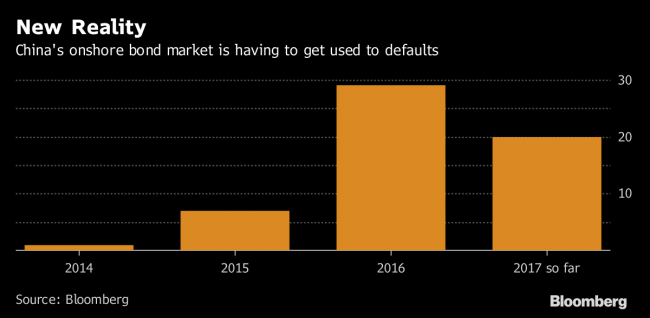

Further developments in recent years featured letting troubled borrowers default, and urging creditors and issuers to engage in debt workouts. Even after some incremental change, China’s market for distressed debt remains “underdeveloped,” Noyes said. “We don’t get a sense of recovery value that could be a valuable input for pricing models for CDS contracts."

China this year saw its first workout plan between a bond issuer and creditors -- read about that here.

Investors have had little gauge of China’s CDS trading volume since an official offered an initial reading on deals late last year. Regulators have yet to allow insurers or mutual funds -- which are typical sellers of protection in developed markets -- to participate in onshore CDS.

"From offshore, it’s hard to get visibility on the size of the onshore CDS market," said Bronwen May, a partner at law firm Hogan Lovells in Hong Kong. “The need for a hedging tool is accepted but we can’t see all of the details -- making it something of a black box for foreign investors,” she said.