Benzinga - by Anusuya Lahiri, Benzinga Editor.

PDD Holdings Inc (NASDAQ:PDD) reported fiscal first-quarter 2024 revenue growth of 131% year-on-year to $12.02 billion (86.81 billion Chinese yuan), beating the analyst consensus estimate of $10.65 billion.

The Chinese online retailer’s adjusted earnings per ADS of $2.83 (CNY20.72) increased from CNY6.92 Y/Y, beating the analyst consensus estimate of $1.42.

Revenues from online marketing services and others rose 56% Y/Y to $5.88 billion.

Also Read: Why Are Chinese Stocks Including Baidu, JD And Others Trading Lower Tuesday?

Revenues from transaction services jumped 327% Y/Y to $6.14 billion.

The Alibaba Group Holding Limited (NYSE:BABA) rival posted an adjusted operating profit of $3.95 billion, up 237% Y/Y.

Pinduoduo held $33.5 billion in cash and equivalents as of March 31, 2024, and generated $2.92 billion in operating cash flow.

Mr. Jiazhen Zhao, Executive Director and Co-CEO of PDD Holdings said, “We will focus our efforts on improving the overall consumer experience, strengthening our supply chain capabilities, and fostering a healthy platform ecosystem.”

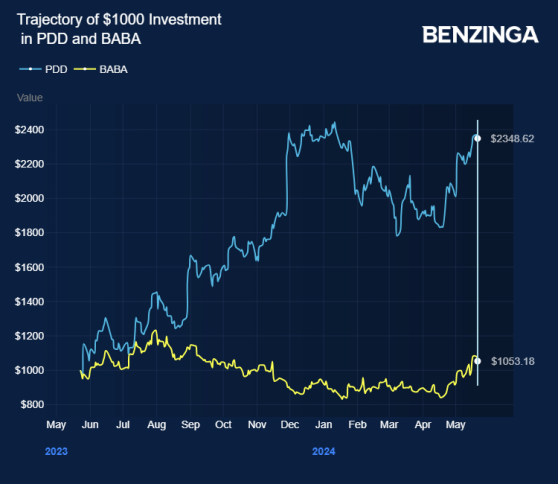

The stock gained 131% in the last 12 months. Investors can gain exposure to the stock via ProShares Online Retail ETF (NYSE:ONLN) and Invesco China Technology ETF (NYSE: CQQQ).

Price Action: PDD shares traded higher by 5.14% at $152.92 at the last check on Wednesday.

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga