Benzinga - by Zacks, Benzinga Contributor.

Agnico Eagle Mines Limited (NYSE: AEM) acquired 33,821,842 Maple Gold Mines Ltd. (OTC: MGMLF) common shares for 8.5 cents per share, totaling approximately C$2.87 million. Shares were purchased from several sellers who had acquired them through a flow-through Common Shares offering by Maple.

Before this acquisition, Agnico Eagle owned 40,852,415 common shares, representing nearly 11.97% of Maple's issued and outstanding shares on a non-diluted basis. Following the share purchase, Agnico Eagle's ownership increased to 74,674,257 common shares, representing around 19.9% of Maple's issued and outstanding shares on a non-diluted basis.

Agnico Eagle and Maple inked an investor rights agreement dated Oct 13, 2020. Under this agreement, as long as Agnico Eagle maintains certain ownership thresholds in Maple, it has specific rights, including the right to participate in equity financings to maintain its pro rata ownership in Maple or to acquire up to 19.9% ownership interest and the right to nominate one person to Maple's board of directors or two persons if the board size increases to eight or more directors.

AEM's acquisition of the common shares is for investment purposes. Depending on market conditions and other factors, it may acquire additional common shares or other securities of Maple or may dispose of some or all of its holdings.

Agnico Eagle and Maple also entered into a conveyance and option agreement on Jun 20, 2024. Subject to certain closing conditions, this agreement entails the termination of the existing joint venture agreement dated Feb 2, 2021, Maple obtaining a 100% ownership interest in the Douay Gold Project and Joutel Gold Project, Maple granting Agnico Eagle a 1% net smelter return royalty on the Projects and Agnico Eagle retaining certain options to acquire a 50% ownership interest in the Projects.

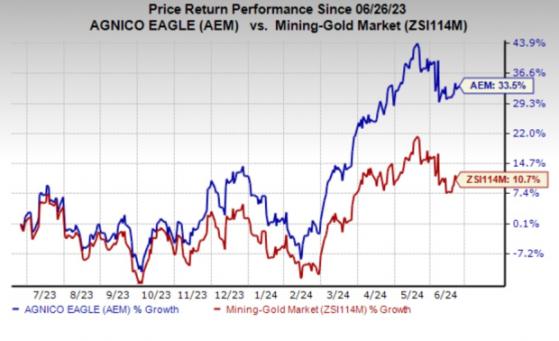

Agnico Eagle's shares have gained 33.5% in the past year compared with a 10.7% rise of the industry.

Image Source: Zacks Investment Research

In 2024, the company expects to produce 3.35-3.55 million ounces of gold, with total cash costs per ounce projected in the band of $875-$925 and all-in sustaining costs (AISC) between $1,200 and $1,250 per ounce. Capital expenditures for the year, excluding capitalized exploration, are estimated to be $1.6 billion to $1.7 billion.

Agnico Eagle Mines Limited Price and Consensus

Agnico Eagle Mines Limited price-consensus-chart | Agnico Eagle Mines Limited Quote

Zacks Rank & Key Picks Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation, ATI Inc., and Ecolab Inc. While Carpenter Technology and ATI sport a Zacks Rank #1 (Strong Buy), and Ecolab carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for CRS's current-year earnings is pegged at $4.31, indicating a year-over-year rise of 278%. CRS' earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, the average earnings surprise being 15.1%. The company's shares have soared 90% in the past year.

ATI's earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 8.34%, on average. The stock has rallied 34.8% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a rise of 26.5% from the year-ago levels. ECL beat the consensus estimate in each of the last four quarters, the average earnings surprise being 1.3%. The stock has rallied nearly 35.6% in the past year.

To read this article on Zacks.com click here.

Read the original article on Benzinga