Benzinga - by Zacks, Benzinga Contributor.

Anheuser-Busch InBev SA/NV (NYSE: BUD), alias AB InBev, has been benefiting from its unique commercial strategy, strong brand portfolio and investments in operational excellence. Continued business momentum due to relentless execution, investment in its brands and accelerated digital transformation have been the key drivers.

Additionally, the company looks well-poised to gain from the expansion of the Beyond Beer portfolio and investments in B2B platforms, e-commerce and digital marketing in the near term. The premiumization of the beer industry has been a key growth opportunity for AB InBev. These have been aiding the company's top line over the past few quarters.

However, BUD has been witnessing higher costs, owing to commodity cost inflation, increased supply-chain costs in some markets, investments in business and elevated operating costs. These have been weighing on the company's bottom-line results.

The Zacks Consensus Estimate for AB InBev's 2024 sales and earnings per share suggests growth of 3.7% and 12.1% year over year, respectively, from the year-ago period's reported numbers.

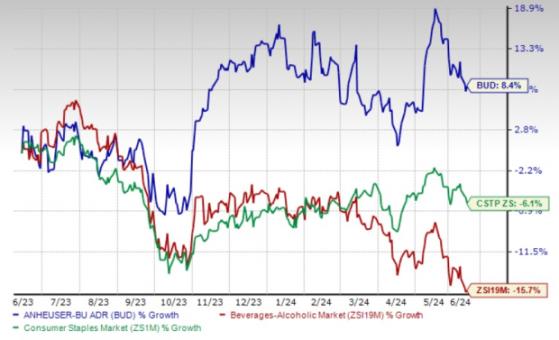

The Zacks Rank #3 (Hold) stock has gained 8.4% in the past year against the industry's growth of 15.7%. The Consumer Staple sector has declined 6.1% in the same period.

Image Source: Zacks Investment Research

What Places BUD Well? AB InBev witnesses positive business momentum on pricing actions, ongoing premiumization and other revenue-management initiatives. Driven by these, the company registered organic revenue growth of 2.6% in first-quarter 2024. Robust revenue per hectoliter (hl) growth and revenue growth in 75% of its markets were the key drivers. Revenues also benefited from its diversified global footprint and the continued momentum of its megabrands, which collectively advanced 6.7% year over year.

The premiumization of the beer industry has been a key growth opportunity for AB InBev. The company has been investing to develop a diverse portfolio of global, international, and crafts and specialty premium brands in its markets. Apart from the premium brands, its global brands lead the way in premiumization.

Ab InBev's above-core portfolio has been performing well for a while now. Revenues for its above core beer portfolio grew in the low-single digits in the first quarter, driven by strength in global brands and double-digit growth of other local megabrands like Leffe in Europe and Spaten in Brazil. The company's global brands' first-quarter revenues grew 5.2% year over year outside their home markets, led by Corona, which improved 15.5%.

AB InBev has been investing in new capabilities for several years to better connect with customers and consumers. It has been rapidly growing its digital platform and leveraging technology, such as B2B sales and other e-commerce platforms, including BEES and Zé Delivery. The company is witnessing an acceleration in the B2B platforms, e-commerce and digital marketing trends, which has been aiding growth in the past few months. BUD's digital transformation initiatives have been on track, with B2B digital platforms contributing about 70% to its revenues in the first quarter.

AB InBev is steadfastly growing its Beyond Beer portfolio, including products like ready-to-drink beverages like Canned Wine and Canned Cocktails, Hard Seltzers, Cider and Flavored Malt Beverages. The Beyond Beer trend is gaining popularity due to the rise in demand for low-alcoholic or non-alcoholic drinks. The company has been focused on expanding its Beyond Beer portfolio, which has also been aiding the top line.

Headwinds in the Path BUD has been witnessing elevated costs from the high commodity cost environment and investments to support long-term growth.

In first-quarter 2024, the cost of sales increased 2.1% on a reported basis and 2.5% on an organic basis to $6.7 billion. The increase mainly resulted from commodity cost inflation and higher supply-chain costs in some markets, offset by improved pricing. SG&A expenses rose 2.1% year over year to $4.4 billion and increased 1.4% on an organic basis, mainly reflecting higher investments in business and elevated operating costs.

Stocks to Consider We have highlighted three better-ranked stocks from the Consumer Staple sector, namely The Vita Coco Company Inc. (NASDAQ: COCO), Vital Farms (NASDAQ: VITL) and PepsiCo Inc. (NASDAQ: PEP).

Vita Coco, a producer and marketer of coconut water products under the Vita Coco brand name, currently flaunts a Zacks Rank of 1 (Strong Buy). COCO has a trailing four-quarter earnings surprise of 25.3%, on average.

The Zacks Consensus Estimate for COCO's current financial-year sales and earnings suggests growth of 3.5% and 40.5%, respectively, from the year-ago reported figures.

Vital Farms offers a range of produced pasture-raised foods. VITL presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 102.1%, on average.

The consensus estimate for Vital Farms' current financial year's sales and earnings per share indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported figures.

PepsiCo, a leading global food and beverage company, currently carries a Zacks Rank #2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PEP's current financial-year sales and earnings indicates growth of 3.4% and 7.1%, respectively, from the year-earlier actuals.

To read this article on Zacks.com click here.

Read the original article on Benzinga