Benzinga - by Zacks, Benzinga Contributor.

The Zacks Transportation - Air Freight and Cargo industry faces challenges, ranging from inflation-induced elevated interest rates to concerns pertaining to supply-chain disruptions and the slowdown of economic growth.

Despite the abovementioned challenges, we believe that the space still has fuel left in the tank, especially for operators that target growth opportunities and undertake cost-reduction initiatives. Even though economies are reopening, consumers' thirst for online shopping is rampant. Cost-cut efforts to drive the bottom line are commendable as well. In view of these favorable developments surrounding the space, we advise investors to focus on United Parcel Service (NYSE: UPS), FedEx (NYSE: FDX) and GXO Logistics (NYSE: GXO).

About the Industry

The companies housed in the Zacks Transportation - Air Freight and Cargo industry provide air delivery and freight services. Most players in the space are involved in offering specialized transportation and logistics services. Some participants offer a range of supply-chain solutions, such as freight forwarding, customs brokerage, fulfillment, returns, financial transactions and repairs. The well-being of the companies in this industrial cohort is directly proportional to the health of the economy. Major industry players, including UPS and FedEx, transport millions of packages each day across the globe. Apart from operating a ground fleet of multiple vehicles, some of these companies also maintain an air fleet. While some players focus on providing air transportation services for passengers and cargo, others deliver services to entities that outsource air cargo lifting needs.

4 Key Trends to Watch in the Transportation-Air Freight & Cargo Industry

Strong Financial Returns for Shareholders: With economic activities gaining pace from the pandemic lows, more and more companies are allocating their increasing cash pile through dividends and buybacks to pacify long-suffering shareholders. This underlines their financial strength and confidence in the business. Among the Transportation – Air Freight and Cargo industry players, FDX announced a 10% increase in its quarterly dividend in June 2024.

Focus on Cost-Cuts to Drive Bottom line: Despite signs of cooling inflation, the measure is still well above the Fed's 2% target.We note that the industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The industry players are focusing on cost-cutting measures and making efforts to improve productivity and efficiency to mitigate high expenses and weaker-than-expected demand scenarios.

Persistent Demand Erosion: A Grave Concern: Due to the decline in shipping demand, particularly in Asia and Europe, volumes are being hurt. Lackluster volumes are hurting the results of key industry players like FDX. FDX reported lower-than-expected revenues in third-quarter fiscal 2024, mainly due to demand woes. The Express unit, FDX's largest segment, was badly hit, with segmental revenues declining 2% year over year due to volume woes. FedEx Freight revenues declined 3%. We expect lackluster shipping demand to have hurt FedEx's performance in fourth-quarter fiscal 2024 as well. Another leading industry player, UPS reported lower-than-expected revenues in first-quarter 2024 due to demand woes.

E-commerce Still a Force to Reckon With: It is hardly surprising that the growth pace of e-commerce demand has slowed from the levels witnessed at the peak of the pandemic, with the reopening of economies. However, it remains impressive, driven by the convenience associated with online shopping. The race to digitization also supports the momentum in e-commerce growth. E-commerce demand strength should continue to support growth of the industry players.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Air Freight and Cargo industry, housed within the broader Zacks Transportation sector, currently carries a Zacks Industry Rank #92. This rank places it in the top 37% of more than 245 Zacks industries.

The group's Zacks Industry Rank, the average of the Zacks Rank of all member stocks, indicates sunny near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Before we present a few stocks from the industry that investors can retain in their portfolios, let's take a look at the industry's recent stock market performance and the valuation picture.

Industry Lags S&P 500 and Sector

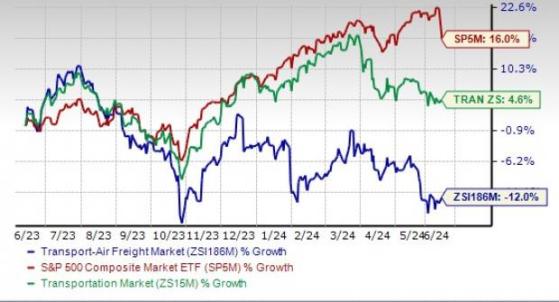

The Zacks Air Freight and Cargo industry has underperformed the Zacks S&P 500 composite as well as the broader Transportation sector over the past year.

The industry has declined 12% over the past year against the S&P 500's gain of 16% and the broader sector's appreciation of 4.6%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), a commonly used multiple for valuing Transportation-Air Freight and Cargo stocks, the industry is currently trading at 10.1X compared with the S&P 500's 13.98X. It is also lower than the sector's trailing 12-month EV/EBITDA of 11.07X.

Over the past five years, the industry has traded as high as 13.58X, as low as 6.64X and at a median of 9.65X.

Enterprise Value-to-EBITDA Ratio

3 Transportation-Air Freight and Cargo Stocks to Keep a Tab On The aforementioned stocks presently carry a Zacks Rank #3 (Hold) each.

UPS: We are appreciative of UPS' efforts to reward its shareholders through dividends and buybacks. Robust free cash flow generation by UPS is a major positive and leading to an uptick in shareholder-friendly activities.

Even though the demand for online shopping has slowed down from the pandemic peak with the reopening of the economy, the figures are still impressive. UPS' earnings outshined the Zacks Consensus Estimate in each of the last four quarters, the average beat being 3.14%.

Price and Consensus: UPS

FedEx: FDX's efforts to reward its shareholders even in these uncertain times are praiseworthy. Apart from paying dividends, FDX is active on the buyback front. FedEx's liquidity position is also solid. The company's efforts to cut costs are driving its bottom line.

FDX's earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed the mark in the other one, the average beat being 8.06%. The Zacks Consensus Estimate for FDX's current fiscal-year earnings suggests growth of 18.72% from the year-ago reported number.

Price and Consensus: FDX

GXO Logistics: We are impressed by GXO's efforts to strengthen its logistics capabilities. The rapid growth of e-commerce, automation and outsourcing is serving the company well.

GXO's earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed the mark in the remaining one, the average beat being 5.59%. GXO's shares have inched up 1% over the past three months.

Price and Consensus: GXO

To read this article on Zacks.com click here.

Read the original article on Benzinga