By Huw Jones

LONDON (Reuters) - Britain's departure from the European Union next year should not be seen as triggering a "race to the bottom" in regulatory standards, a top UK regulator said on Monday.

Brexit supporters say Britain should ditch some EU financial rules, such as caps on banker bonuses, to help keep the City of London competitive as a global financial centre.

Paris, Frankfurt, Dublin and Luxembourg are vying to attract financial firms from Britain, though the number of job moves so far is modest.

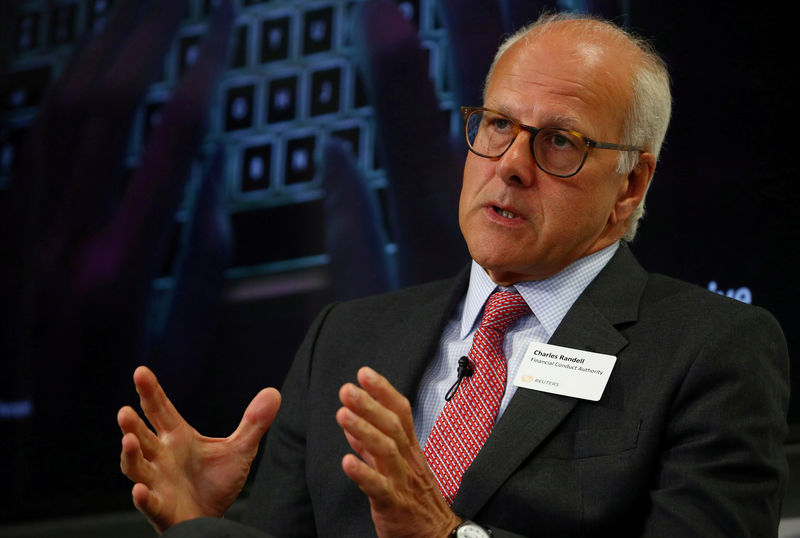

Charles Randell, chair of the Financial Conduct Authority, said Britain may have choices to make about regulation after Brexit, but there was a need to break the "damaging cycle" of deregulation, a crisis and new rules.

"The FCA does not see the UK's withdrawal from the European Union as an opportunity to join a race to the bottom in regulatory standards – quite the contrary," Randell told a conference held by AFME, a banking industry body.

Some UK lawmakers have said the FCA and its sister regulator, the Prudential (LON:PRU) Regulation Authority (PRA) at the Bank of England, should have a formal objective of maintaining competitiveness, meaning new financial rules must not be overly burdensome.

UK regulators had a competitiveness remit in the run up to the 2007-09 financial crisis, and Randell said restoring this objective could imply some very difficult trade-offs with its existing objectives.

"How much loss of competition should we tolerate to ensure that a sector is competitive? How much loss of consumer protection? How much loss of market integrity?"

"I believe that if we deliver our existing statutory objectives of making our markets work well, consumer protection, competition and market integrity, then there should be nothing to stop the firms we regulate from making money and growing in global markets."

It was easy to underestimate the huge advantages London has in strength and depth in a wide variety of specialist markets, Randell said.

The watchdog has already said it will review its rules "handbook", but Randell said this would only happen once the "post-Brexit landscape" is clear.

Britain may have to rely on the EU's "equivalence" system for access to the bloc's financial market, which hinges on avoiding diverging from the continent's rules.

The PRA disappointed insurers by deciding not to ease an EU capital rule, and the FCA is under pressure from the asset management sector to rewrite EU rules on disclosures to investors.