Gold prices set for weekly gains on dovish Fed outlook; silver near record high

Proactive Investors - Cable is reacting positively to today’s mixed-bag inflation read in the UK

As expected, year-on-year inflation came in at 10.5% for December 2022, marking the second consecutive month that the rate fell, with cheaper fuel and energy costs the driving forces behind the drop, while rising food costs worked against any steeper declines.

Having closed 75 pips higher at 1.228 on Tuesday, sterling maintained its bullish position against the dollar in this morning’s Asia session, hitting highs of 1.231 last witnessed in mid-December.

Traders are cognizant of the fact that, despite a slight softening of the economy, these are still hugely unsustainable numbers that will require hawkish financial policy from the Bank of England.

Sjaene Higgins, mortgage operations manager at the Wesleyan Group, predicted: “In little more than a year, we’ve already seen nine hikes to the interest rate, from 0.1% to 3.5%. And it’s almost inevitable that the rate will keep going up during 2023, potentially to around 4.75% by the middle of the year, with little prospect of it falling back until 2024.

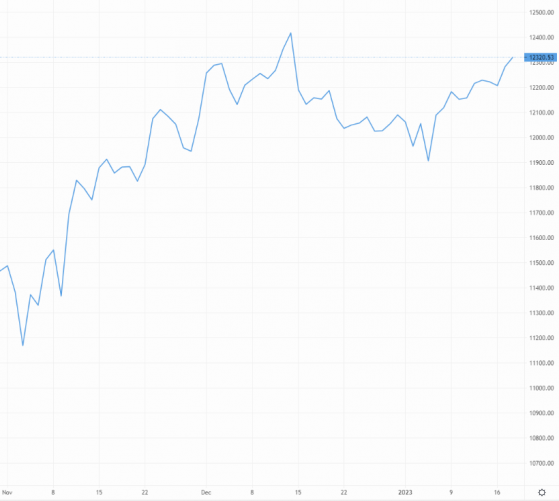

GBP/USD traders push pair above four-week highs – Source: capital.com

There is a tonne of other economic data to come, including the producer price index (PPI) and retail prices in the UK, inflation and construction output in the EU, and retail sales and PPI in the US, so there’s no telling where Cable will move to next.

The pound continued to beat the euro after nearly 100 basis points (bps) was slashed from EUR/GBP yesterday, with another 10 bps conceded this morning to bring the pair down to 87.74p.

EUR/USD is far less volatile than the other main pairs. The euro added 0.2% against the greenback in th outis morning’s Asia session, bringing the pair to 1.081.

Despite market speculation, the Bank of Japan made no overtures to tightening its soft-touch approach to interest rates. As a result, GBP/JPY surged a meaty 2% to 160.70, thus cancelling out the gains the yen made in the week prior.