Proactive Investors - US interest rates are front and centre in today’s market discussion as the Federal Reserve prepares to implement what will likely be another 25 basis point (bps) hike to bring its base rate up to 4.75%.

Fed chair Jerome Powell could still deliver a hawkish surprise in the contents of his press conference, though yesterday’s softish employment cost data helped to drive the dovish narrative.

As Michael Hewson of CMC Markets commented, there seems to be a disconnect between what the market expects to happen (a pause of hikes), and what the Fed has explicitly said (more hikes are needed).

“It is this disconnect between the Fed’s rhetoric and what the market is pricing which makes today’s Federal Open Market Committee rate decision and Powell press conference very much a ‘live’ meeting," noted Hewson.

The greenback is seeing bearish sentiment in the run-up to the Fed conference, having closed 0.14% lower at 101.71 on Tuesday and it fell incrementally more this morning.

Sterling suffered worse, having fallen against the greenback, but it was the losses against the euro that really bruised, with EUR/GBP rallying 0.44% to close Tuesday at 88.23 while adding another few pips this morning.

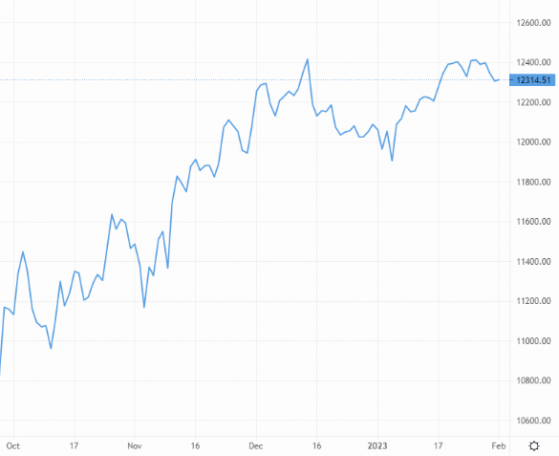

Cable eases – Source: capital.com

UK Mortgage lending was exceptionally underwhelming in yesterday’s data, coming in considerably lower than expected providing sure-fire proof that interest rates are starting to bite into the overheated economy.

Whether the euro’s strength stays in place will be determined after this morning’s EU unemployment numbers and year-on-year inflation rate, which should give an indication of where the eurozone is on a macro level.

In the meantime, EUR/USD pulled itself up from an intraday low of 1.080 to close the Tuesday session on a high, before adding another 0.12% to 1.087 this morning.

Read more on Proactive Investors UK