By Huw Jones

LONDON (Reuters) - The job of fixing flaws that led to the 2007-09 financial crisis is largely done and the focus will turn to spotting new risks and rebuilding trust among regulators, a global watchdog set up by the Group of 20 (G20) leading economies said on Friday.

The Financial Stability Board (FSB) has coordinated the enforcement of rules forcing banks to hold more capital after many were bailed out by taxpayers in the crisis.

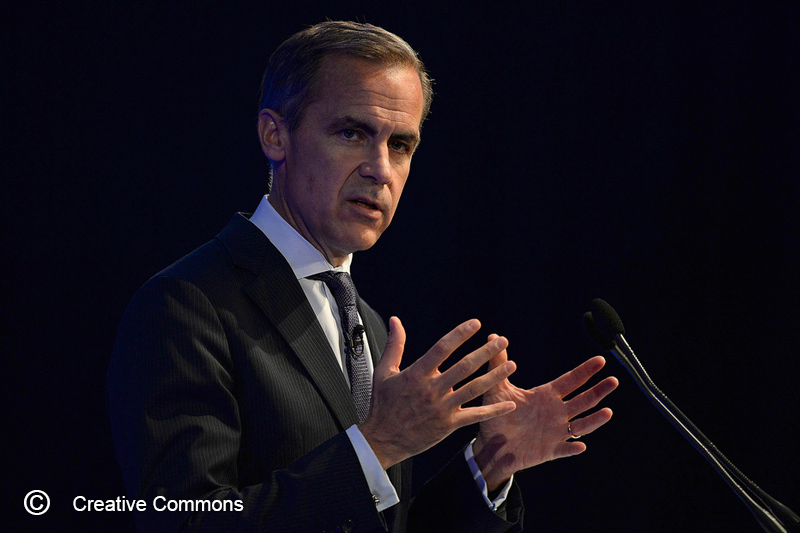

"The G20 has worked intensively over the past six years to correct the fault lines that led to the global financial crisis," FSB Chairman Mark Carney said in a letter to G20 leaders meeting in Brisbane, Australia.

While the job is "substantially complete", further work remains in order to build a fully resilient system, said Carney, who is also governor of the Bank of England.

Earlier this week, the FSB unveiled the last major piece of crisis reforms, a proposed requirement for banks to hold equity and bonds equivalent to 16 to 20 percent of their risk-weighted assets to shield taxpayers in a collapse.

Sven Giegold, a Green party member of the European Parliament, said Carney was being overly optimistic as large banks remain "too big to fail". Giegold doubted that regulators would allow several big banks to collapse in a crisis.

The FSB has already finalised tougher standards for financial derivatives like credit default swaps but Carney said implementation is uneven and behind schedule.

Carney said the next phase for the FSB was to focus on new and constantly evolving risks from "shadow banking" or institutions that deal in credit outside traditional banking.

He will also focus on how rules are implemented and make refinements if needed.

The FSB would work to rebuild trust among regulators to stop countries fragmenting global markets by taking unilateral steps to shield their taxpayers from a failing foreign bank.

The FSB has already set global principles for banker bonuses, such as requiring a portion to be deferred over several years, and Carney said it will now focus on the link between pay, risk appetite and governance of banks.

Pay structures at top insurers will be looked at in 2015.

The watchdog also confirmed it will revise how it plans to select big asset managers for tougher scrutiny, saying it will develop incremental policy measures to address the systemic risks they pose.

(Editing by David Holmes and Pravin Char)