(Reuters) - Allergan Inc (N:AGN) on Monday accepted a $66 billion (42 billion pound) takeover bid from Actavis Plc (N:ACT), closing the door on a hostile offer from activist investor William Ackman and Valeant Pharmaceuticals International Inc (TO:VRX).

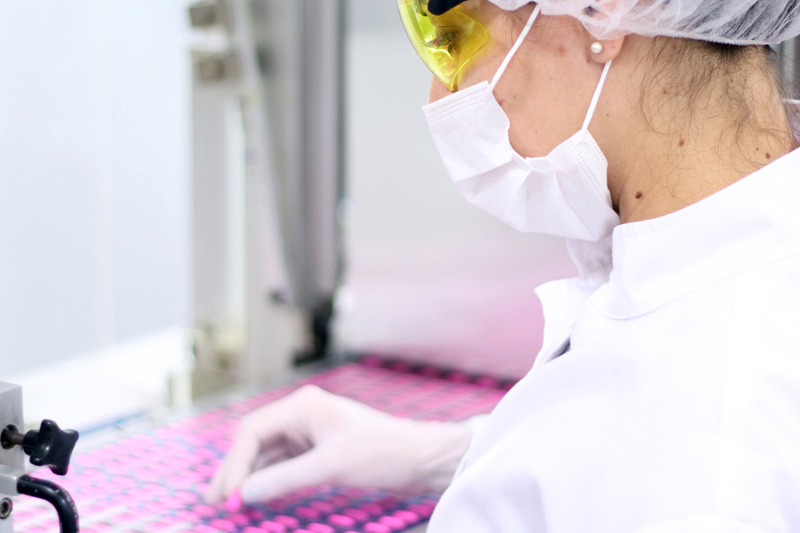

The cash-and-stock deal values Allergan at $219 per share and is $6 billion more than the price Valeant had last offered to pay. Valeant said in a statement that it could not justify paying such a high price for Allergan, which makes the Botox wrinkle treatment.

The deal came after Allergan spent six months maneuvering against a takeover by Ackman and Valeant, including in a legal battle. Allergan Chief Executive Officer David Pyott had said shareholders would be hurt because Valeant's cost-cutting, particularly in research and development, would stop its growth, and he questioned Valeant's accounting.

Actavis CEO Brent Saunders will lead the combined company, which will have $23 billion in revenue. It will include Allergan's ophthalmology, neurosciences, and dermatology business and Actavis' gastroenterology and women's health franchises.

Actavis said it expected $1.8 billion in savings, on top of the $475 million in cuts that Allergan has already made this year, and annual research and development spending of $1.7 billion.

Allergan shares rose 6.6 percent to $211, earning Ackman a payout of more than $2.4 billion on his nearly 10 percent stake in the company. Valeant's latest cash-and-stock offer was worth about $54 billion, although it had said it would pay up to $200 per share, or about $60 billion.

A spokesman for Pershing Square Capital Management did not have an immediate comment.

Actavis said it would pay $129.22 in cash plus 0.3633 share for each Allergan share.

Valeant shares rose 1 percent to $135.56 on the New York Stock Exchange. Actavis gained 3 percent to $251.03.

Actavis was advised by J.P. Morgan and law firm Cleary Gottlieb Steen & Hamilton. Allergan was advised by Goldman Sachs & Co and BofA Merrill Lynch as well as law firms Latham & Watkins, Richards, Layton & Finger and Wachtell Lipton Rosen & Katz.

(Reporting by Caroline Humer; Additional reporting by Rod Nickel in Winnipeg, Manitoba; Editing by Bernadette Baum and Lisa Von Ahn)