(Reuters) - Britain's anti-fraud agency has launched an investigation into business and accounting practices at insurance claims processor Quindell (L:QPP), it said on Wednesday, as the company announced a 238 million pound ($372 million) loss for 2014.

Quindell, under new management this year, said the investigation by the Serious Fraud Office (SFO) related to past practices, and that the 2014 loss was due largely to impairments on various transactions and a change in accounting practices.

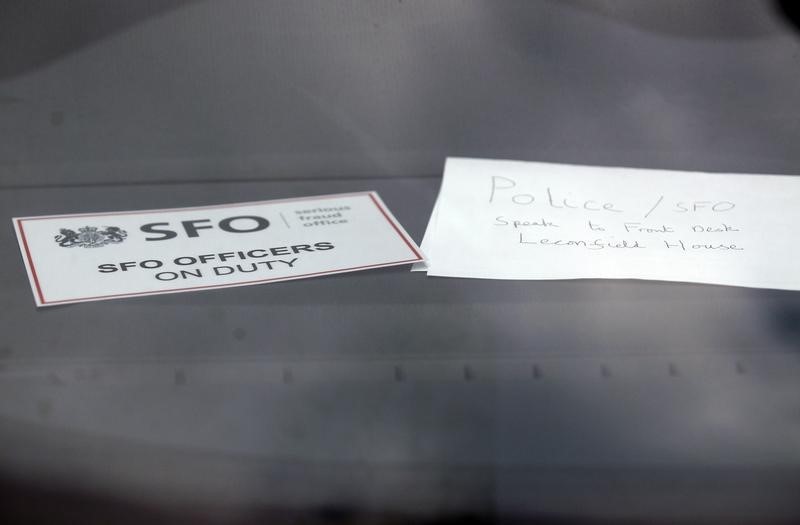

"The SFO confirmed today that the Director has opened a criminal investigation into business and accounting practices at Quindell plc," the agency said in a statement, without providing further details.

Quindell appointed PricewaterhouseCoopers in December to help review cash flows, business plans and accounting policies after the ouster of its founder in November.

Its 2013 and 2014 publicly released financial statements are already being investigated by Britain's financial regulator, the Financial Conduct Authority.

Another regulator, the Financial Reporting Council (FRC) said on Wednesday it was closing a separate review of Quindell's 2011 and 2012 accounts after the company corrected errors and amended accounting policies.

Quindell's auditor for 2011 and 2012 was RSM Tenon Audit Ltd, which got acquired by Baker Tilly in 2013. KPMG took over as the auditor in October 2013.

The FRC is still investigating Quindell's books for 2013 and 2014.

Quindell Chairman Richard Rose, who took charge in January, and Finance Director Mark Williams, named to the post in April, declined to say whether the accounting errors were deliberate.

"That's an impossible question to answer," Rose said on a media call. "We are the new management and we have worked with the information we have got at hand."

The company said its pretax loss ballooned to 238 million pounds in 2014 from a restated 8.6 million for 2013, hurt by about 157 million in impairment charges and 37.4 million of exceptional costs.

It forecast revenue to remain largely flat in 2015, compared with 72 million pounds for 2014.

Trading in Quindell's shares was halted on June 29, pending the publication of its 2014 results.

The company said it had requested for the suspension to be lifted on Thursday.

Quindell sold its Professional Services business -- which provides legal, claims management, health and medical reporting services -- in March to focus on its insurance-related technology business.

The company said it planned to distribute proceeds from the sale via a capital distribution of 1 pound per share to shareholders by autumn.