By George Georgiopoulos and John O'Donnell

ATHENS/FRANKFURT (Reuters) - The European Central Bank rejected Greece's request for 6 billion euros of extra emergency funds on Sunday, but is expected to continue limited support for Greek banks until the July 5 referendum, people with knowledge of the matter said.

The size of the request underscores the scale of the panic gripping Greek savers, and would have left the ECB in little doubt about the dramatic consequences of rejecting it.

However, the prospect that existing central bank funding will not be withdrawn offers hope that some banks will briefly open their doors, for example to pay pensions.

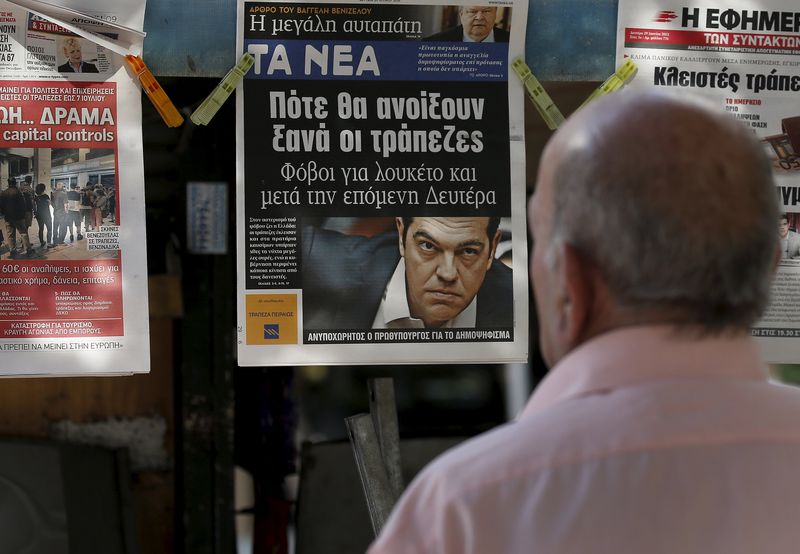

Greeks had rushed to withdraw their money after Prime Minister Alexis Tsipras on Saturday promised a snap vote next Sunday on the stringent terms demanded by creditors in return for cash to prevent Greece defaulting on its debts.

The Bank of Greece in turn asked the ECB's policy-setting Governing Council to approve a top-up to an 89-billion-euro emergency credit line on Sunday, to cover the shortfall.

"The request by the Bank of Greece was for 6 billion euros of ELA (Emergency Liquidity Assistance)," said one of the people with knowledge of the talks. "The recommendation submitted to the ECB was signed by the governor (of the Bank of Greece)."

The ECB, which had been steadily increasing the amount of funding available to the banks, froze it on Sunday, meaning banks were unable to open and forcing Tsipras to impose capital controls to stop withdrawals.

As a small concession, however, Greece is expected to be able to continue tapping what remains of the emergency funding support already allocated, keeping the banks just above water.

Although a formal proposal has yet to be made and the situation is fast-moving, people who spoke to Reuters said they now expected euro zone central bank chiefs and ECB President Mario Draghi to keep the remaining support open at the current level when they meet on Wednesday.

Capital controls have stopped panicked savers from withdrawing large sums of money, which means that the current level of emergency liquidity, used to cover those payouts, could be enough to see Greek banks through the week.

SOME BANKS TO REOPEN

A Greek government official said banks were expected to open 850 branches for the payment of pensions on Thursday, a step for which continued ECB support would be necessary.

Such backing could also help them to increase a current daily withdrawal limit of 60 euros at cash machines, said the official.

Commenting on the expected continuation of emergency funding, albeit only at its current level, one source said: "It doesn't make sense to stop it now. The banks aren't able to pay it back anyway. So if you froze it for another two or three days, it wouldn't make any difference.

"With the referendum, you then have some sort of indication as to how things will go forward."

Were Athens to default on payment to the International Monetary Fund, it would make it harder to justify such support because it would call into question the solvency of Greek banks, a condition of the funding.

Greek banks are closely intertwined with the state and count tax credits from the government as part of their capital cushion. Were the government to default, those would be worthless.

But the ECB, reluctant to be blamed for triggering a Greek financial collapse and risking its ultimate departure from the euro zone, may choose to ignore this, at least initially.

The expiry of Greece's bailout programme on Tuesday would not necessarily bar it from getting such funding for its banks. Both Ireland and Cyprus benefited from such emergency funding before they were in a bailout programme.

Continued support of Greece's banks is likely to run into opposition from Germany's influential Bundesbank. German Finance Minister Wolfgang Schaeuble is also known to be sceptical.

The Bundesbank's chief, Jens Weidmann, has long been critical of such credit, believing that it amounts to the ECB bankrolling Greece.

He fears other countries could be left to pick up the bill if Athens tumbles out of the 19-country currency bloc.