Proactive Investors - The forex markets kicked off the new year in a muted fashion.

Cable continued to trade sideways on Monday as we entered the first trading session of 2023, having opened at 1.208 and closed 28 pips down at 1.206, where it has stayed in this morning’s Asia hours.

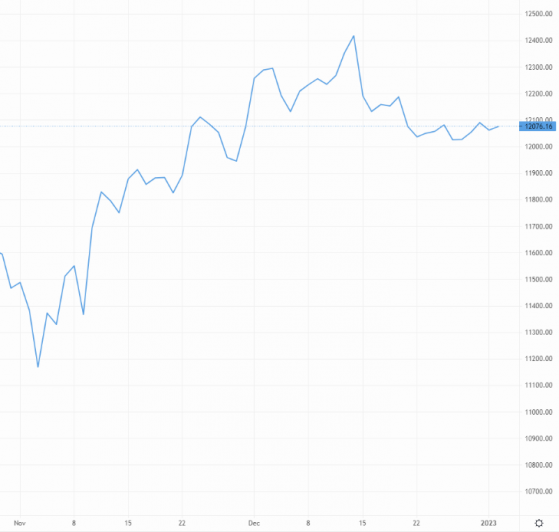

Cable kicks off 2022 in muted fashion – Source: capital.com

Commencing trade on Tuesday, the US Dollar Index (DXY) remains on the weaker side at 103.36; a fair way below the 20-day moving average.

Yet the euro lost ground against the greenback too, with the EUR/USD pair dipping 0.3% on Monday and continuing to fall another 0.25% this morning, where it currently changes hands at 106.53.

Eurozone manufacturing data released yesterday indicated somewhat of an easing of the industry’s downturn, although output for the entire fourth quarter is likely to have been on the negative side.

Things were worse for manufacturing output in the UK, with today’s reading showing the weakest output since May 2020 for the month of December, spurred by lukewarm new business volumes and exports.

EUR/GBP fell a quarter of a percent to 88.29p in Tuesday’s Asia window, but the pair is still substantially above the 20-day moving average owing to a bullish December.

Things are quiet on the economic calendar today, but tomorrow will give us mortgage data on both sides of the Atlantic. Mortgage approvals in the UK are expected to gain slightly, with net lending expected to come in at £3.7bn.

Read more on Proactive Investors UK