By Paul Carrel and Jussi Rosendahl

BERLIN/HELSINKI (Reuters) - German Chancellor Angela Merkel ruled out a debt writedown for Greece on Saturday, and a European Central Bank policymaker threatened to cut off funding to Greek banks if Athens does not agree to renew its bailout package.

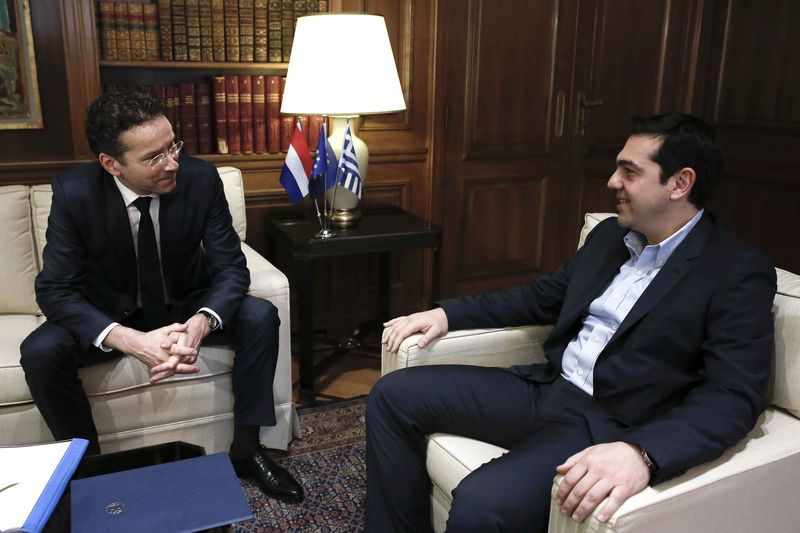

The euro zone's paymaster and the ECB are both taking a tough line with Greece's new leftist government, whose leader swept to victory last Sunday promising that five years of austerity, "humiliation and suffering" were over.

Alexis Tsipras has also promised to renegotiate agreements with the European Commission, ECB and International Monetary Fund "troika" and write off much of Greece's 320 billion euro (239 billion pounds) debt, which at more than 175 percent of gross domestic product is the world's second-highest after Japan.

Merkel flatly rejected such a possibility.

"There was already a voluntary waiver by private creditors; Greece has already been exempt from billions by the banks. I don't see a further debt haircut," she told German daily Die Welt in an interview published in its Saturday edition.

"Europe will continue to show solidarity for Greece, as for other countries hit particularly hard by the crisis, if these countries undertake their own reforms and savings efforts," Merkel added in a thinly veiled threat to Athens.

Without the support of international lenders, Greece would soon find itself back in an acute financial crisis.

Unable to tap the markets because of sky-high borrowing costs, Athens has enough cash to meet its funding needs for the next couple of months. But it faces around 10 billion euros of debt repayments over the summer.

"I'M WAITING," MERKEL TELLS ATHENS

Greece's new government opened talks on its bailout with European partners on Friday by refusing to extend the programme or to cooperate with the international inspectors overseeing it.

Separately, the French finance ministry said on Saturday that Greek Finance Minister Yanis Varoufakis will meet with his French counterpart Michel Sapin in Paris on Sunday and issue a statement afterwards.

Europe's bailout programme for Greece, part of a 240 billion euro rescue package also involving the International Monetary Fund, expires on Feb. 28. A failure to renew it could leave Athens unable to meet its financing needs and cut its banks off from central bank liquidity support.

The ECB does not accept Greek sovereign bonds as collateral in its refinancing operations as they are below investment grade. However, it allows central bank financing to Greek banks as the country is in a bailout programme.

Erkki Liikanen, a member of the ECB's policymaking Governing Council, said that funding, too, could dry up if Greece does not remain in a programme.

"Greece's programme extension will expire in the end of February so some kind of solution must be found, otherwise we can't continue lending," Liikanen, also the governor of Finland's central bank, told public broadcaster YLE.

Merkel said the ECB's Jan. 22 decision to pump billions of euros into the euro zone with a bond-buying programme did not mean countries would end efforts to shape up their economies with structural reforms.

She put the onus on the new Greek government to present a credible economic policy.

"The goal of our policy was and is that Greece remains a permanent part of the euro-community," Merkel said.

"To that end, Greece and the European partners make their contribution. Apart from that, I am now waiting to see what concepts the Greek government will present."