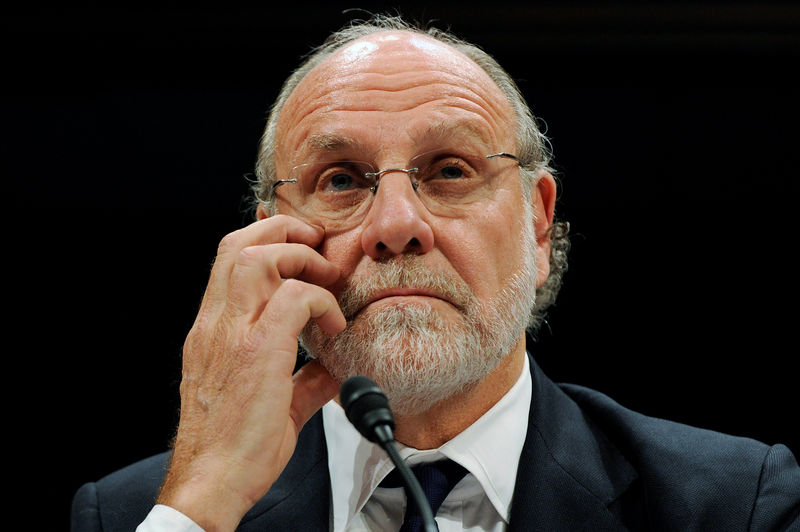

NEW YORK (Reuters) - PricewaterhouseCoopers LLP has settled a $3 billion (2 billion pound) negligence lawsuit over the October 2011 collapse of MF Global Holdings Ltd, the futures and commodities brokerage once run by former New Jersey governor Jon Corzine.

Terms were not disclosed, but the malpractice case was "settled to the mutual satisfaction of the parties," representatives for PwC and MF Global's bankruptcy administrator said in separate statements on Thursday.

The accord ends the last major piece of litigation that the administrator, hedge fund founder Nader Tavakoli, has been pursuing on behalf of MF Global creditors.

It also ends a trial that began on March 7 in the U.S. District Court in Manhattan, where several witnesses including Corzine had already testified.

PwC has denied wrongdoing. It blamed Corzine's business strategy and the market's reaction to it for MF Global's demise.

In April 2015, PwC reached a separate $65 million settlement with MF Global investors, but denied wrongdoing there too.

Lawyers for both sides on Thursday declined to comment or were not immediately available for comment.

MF Global filed for Chapter 11 protection on Oct. 31, 2011 as news about Corzine's $6.3 billion wager on European sovereign debt, a surprise tax writedown, and credit rating downgrades fuelled worries about its survival.

Investors became upset when MF Global moved the European debt onto its balance sheet on Oct. 25, 2011, after previously discussing it more generally in regulatory filings.

The administrator faulted PwC over the accounting for "repurchase-to-maturity" transactions through which Corzine bet on the European debt, and for changing its advice on deferred tax assets, causing the writedown.

Corzine, also a former New Jersey senator and Goldman Sachs (N:GS) co-chairman, testified that he had trusted PwC because of its strong reputation. He also called the European debt a low-risk investment that ultimately paid in full.

In January, Corzine agreed to pay $5 million and accept a lifetime U.S. Commodity Futures Trading Commission ban to settle claims by that agency.

Corzine, 70, now runs an office focussed on charitable giving and his family's investments, and has taught at Fairleigh Dickinson University.