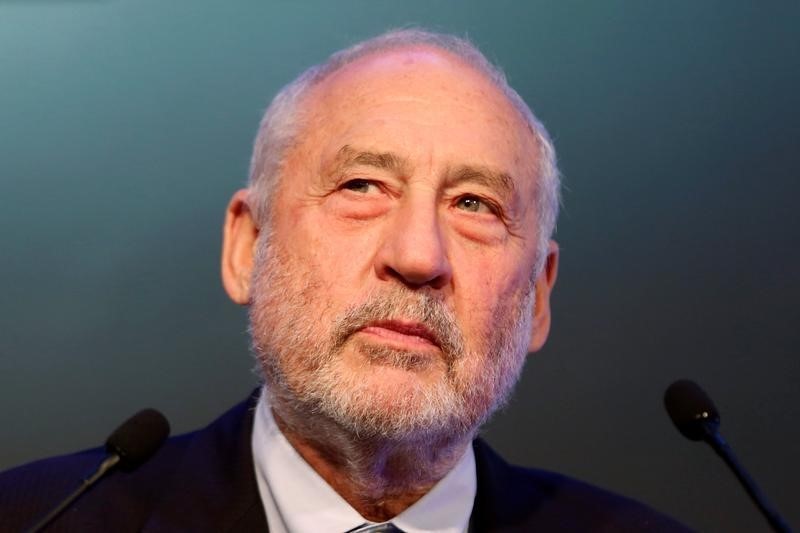

BERLIN (Reuters) - Nobel Prize-winning economist Joseph Stiglitz predicted in a interview out on Wednesday that Italy and other countries would leave the euro zone in coming years, and he blamed the euro and German austerity policies for Europe's economic problems.

Europe lacks the decisiveness to undertake needed reforms such as the creation of a banking union involving joint bank deposit guarantees, and also lacks solidarity across national boundaries, Stiglitz was quoted as saying by Die Welt newspaper.

"There will still be a euro zone in 10 years, but the question is, what will it look like? It's very unlikely that it will still have 19 members. It's difficult to say who will still belong," the paper quoted Stiglitz as saying.

"The people in Italy are increasingly disappointed in the euro," Stiglitz was quoted as saying. "Italians are starting to realise that Italy doesn't work in the euro," he added.

He said Germany had already accepted that Greece would leave the euro zone, noting that he had advised both Greece and Portugal in the past to exit the single currency.

Concerns about the euro zone have escalated in Germany in recent months amid growing concern about a shift away from austerity in southern Europe, the loose money policies of the European Central Bank and the rise of the right-wing Alternative for Germany party.

Stiglitz told the paper the euro and austerity policies in Germany were at fault for Europe's economic malaise. The break-up of the single currency or the division into a north euro and a south euro were the only realistic options for reviving Europe's stalled economy, the paper quoted him as saying.

The former chief economist of the World Bank said Europe and the United States had similar economies, resources and labour pools, but the U.S. economy had recovered from the global financial crisis while the European economy had not.

"The big difference is the euro," he said, noting that the single currency was weighing on the overall European economy.

The euro reached a three-week high against the yen on Wednesday, a day after a Bloomberg article cited sources as saying the European Central Bank would probably wind down its bond buying gradually before ending quantitative easing.