By Lucy Raitano

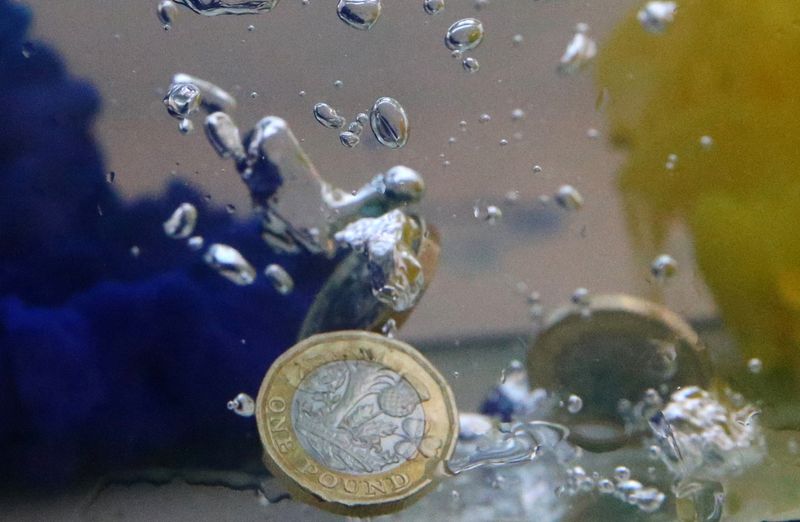

LONDON (Reuters) - Sterling fell against the U.S. dollar and the euro on Wednesday, holding close to last week's one-month low as traders stay cautious on the currency and focused on the weak UK economy.

At 1103 GMT, the pound was down 0.1% against the dollar at $1.2737 and 0.3% lower against the euro at 86.21 pence.

Market players pointed to euro strength as the key driver, with Italian banking stocks regaining some of the ground lost in the previous session after the government late on Tuesday watered down a surprise windfall tax on the sector.

Stuart Cole, chief macro economist at Equiti Capital, said the update from the Italian government provided the euro with a moderate boost, explaining sterling's softness.

"But the euro is also very much pushing against an open door vis-a-vis sterling, as the recent loss in value we have seen over the past week reinforces the bearish view I think the market has on the currency right now, which is reflective of the underlying weakness of the UK economy," Cole added.

The pound has fallen over 3% since July 13 when it touched $1.31440 against the dollar, its highest since April 2022.

Surging interest rate expectations were tempered after British inflation fell more than expected in June.

Colin Asher, senior economist at Mizuho Corporate Bank, sees further sterling softness in the short term.

"In terms of sterling in the short run, everyone got a little bit excited about nominal rates going up. The data show that GBP positioning is elevated. I expect the economy will soften and rate expectations will ease, which in turn will weigh on GB," said Asher.

On Aug. 3, the Bank of England (BoE) raised interest rates for the 14th time since late 2021 to try to calm inflation.

Traders are predicting around a 60% chance of a 25 basis point hike from the BoE at its next meeting on Sept. 21, and around a 40% chance of no change.