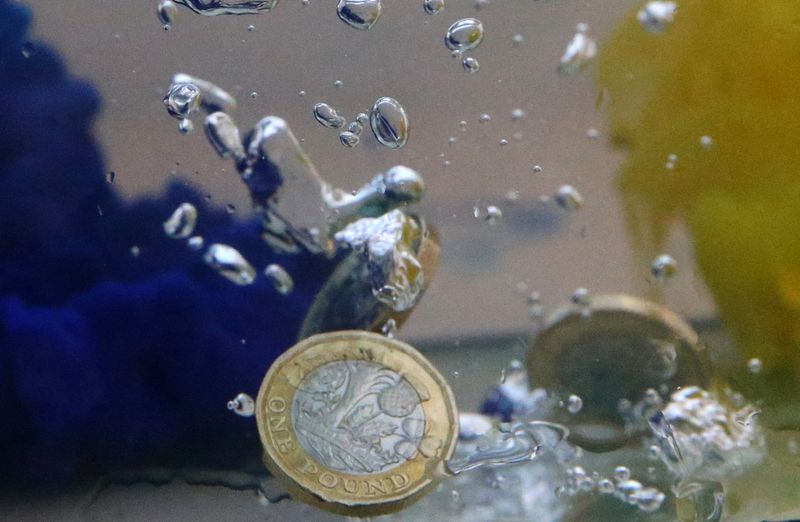

LONDON (Reuters) - The pound softened on Friday as gloomy market sentiment sent investors to the safe haven of the U.S. dollar, and British retailers reported a bigger-than-expected drop in sales in July.

Official data showed British sales volumes last month were 1.2% lower than in June, as heavy rain put off shoppers who are also feeling the hit from high inflation and 14 back-to-back increases in interest rates.

Economists polled by Reuters had forecast a 0.5% drop.

The pound was last 0.16% lower against the dollar at $1.2727 snapping three days of gains, and also weakened against the euro, which rose 0.18% to 85.46 pence.

Sterling reached its strongest in a month on Thursday at 85.24 per euro.

Recent British data, including GDP and wage numbers, has come in stronger than expected, driving market expectations for more Bank of England interest rate hikes.

These signs of economic resilience at a time when inflation remains sticky mean markets are nearly pricing in a 6% peak for the UK benchmark rate, which currently stands at 5.25%.

Expectations that BoE tightening will continue for longer than at the U.S. Federal Reserve and European Central Bank, which may have finished their rate hiking cycles, have supported the pound this year.

Friday's soft retail sales data seems unlikely to disrupt this narrative significantly.

"Slowing retail sales would normally be seen as a sign of consumer stress, but this feels more like a weather-related blip and it’s unlikely the Bank of England will give these numbers anything more than a cursory glance when it comes to next month’s interest rate decision,” said Danni Hewson, head of financial analysis at AJ Bell.

The pound was still set to post a weekly gain of 0.32% against the dollar.