By Jane Wardell

CANBERRA (Reuters) - The Australian government is expected to announce a A$5 billion (2.6 billion pounds) fund for major public transport projects as part of its federal budget, a spending plan under more scrutiny than usual as it doubles as an unofficial election campaign launch.

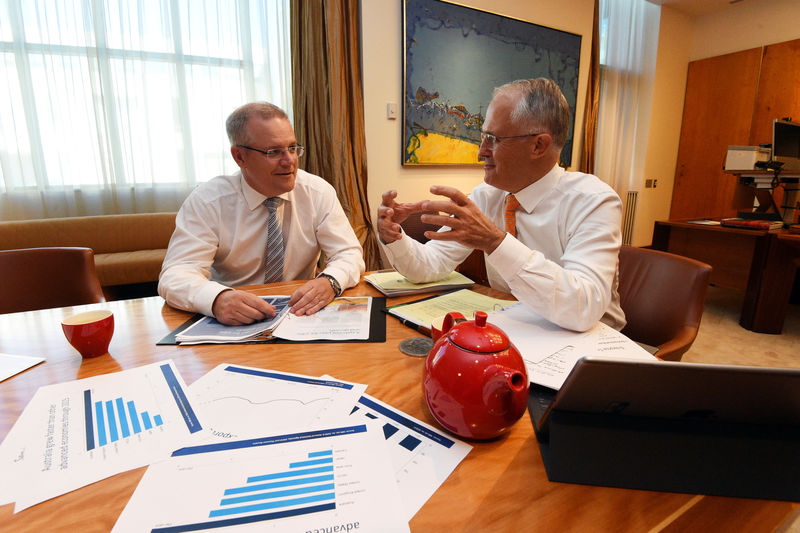

Treasurer Scott Morrison, presenting his rookie budget on Tuesday, faces the tough job of delivering a pro-growth, voter-friendly spending plan without any leeway to offer "big bang" reforms or significant tax giveaways.

As Australia heads to an early election on July 2 after political wrangling that resulted in the dissolution of parliament, Morrison and Prime Minister Malcolm Turnbull are cautioning that the country has to "live within its means."

"It's not a typical budget," Morrison told reporters in Canberra on Monday. "This is not a time to be throwing money around."

"You have to spend money wisely, you have to target it and the ultimate test is will it drive jobs and growth - we'll afford the things that need to be afforded in health and education."

The ruling Liberal Party-led coalition government is running neck and neck with the Labor Party, latest opinion polls show, putting Turnbull in a tough position as he seeks his first mandate since wresting the top job from the hugely unpopular Tony Abbott in a leadership coup last year.

Turnbull has stressed his spending plan will be a break from Abbott's deeply unpopular 2014 budget - but unlike Abbott who had another shot in 2015, Turnbull has no time to recover before the election if voters don't like what they see on Tuesday.

The government is keen to drive home the message that it alone can be trusted to manage an economy hampered by the end of a once-in-a-century mining boom and balance public finances after years of deficits.

Recent data showed economic growth picked up momentum in the fourth quarter, providing a political boost to the coalition government.

A rally in prices for some of Australia's top exports, such as iron ore, promises to boost the government's tax take which could prevent another embarrassing miss on the deficit.

Morrison should report the red ink matched forecasts at around A$37 billion (19.2 billion pounds) this financial year and allow him to offer the aspirational goal of small fiscal surpluses from 2021-22 onwards.

Major Projects Minister Paul Fletcher said the A$5 billion Asset Recycling Initiative, which requires state and territory governments to privatise assets to fund their share, would have an economic impact.

"Infrastructure is enormously important to our productivity, to our competitiveness," Fletcher said.

The budget is also expected to announce an easing of the company tax burden and to tighten loopholes in multinational tax arrangements.