Investing.com - According to the latest Economic Outlook report from the OECD (Organisation for Economic Co-operation and Development), released on Wednesday, global growth will remain modest and the impact of the necessary tightening of monetary policy, weaker trade and weaker business and consumer confidence will be increasingly felt.

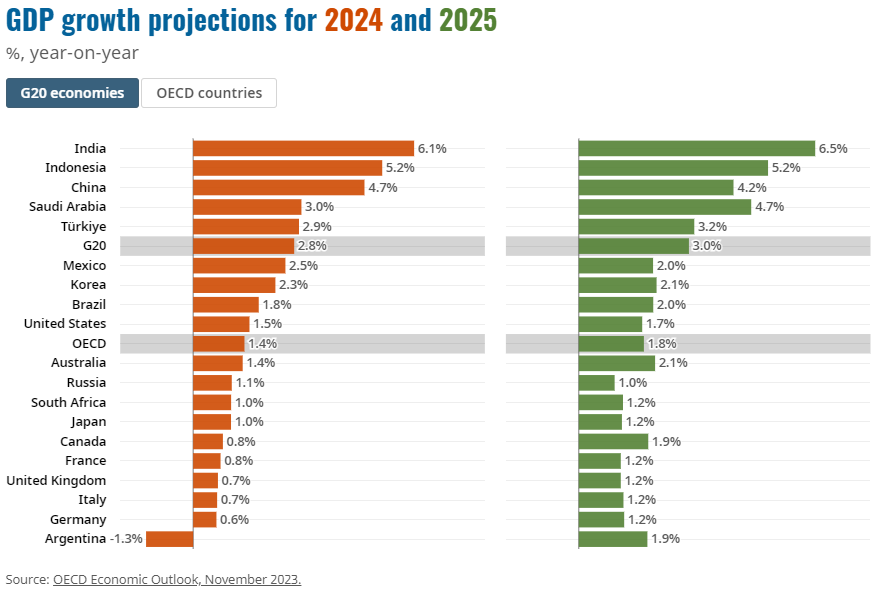

The outlook projects global GDP growth of 2.9% in 2023, followed by a slight deceleration to 2.7% in 2024 and a slight improvement to 3.0% in 2025. Asia is expected to continue to account for the largest share of global growth in 2024-25. as it has done in 2023.

The OECD expects consumer price inflation to continue to decline gradually towards central bank targets in most economies by 2025, as cost pressures moderate. Consumer price inflation in OECD countries is expected to decline from 7.0% in 2023 to 5.2% in 2024 and 3.8% in 2025.

Inflation

The Organisation projects GDP growth in the United States to be 2.4 per cent in 2023, before slowing to 1.5 per cent in 2024 and then picking up slightly to 1.7 per cent in 2025, as monetary policy is expected to ease. In the euro area, which had been relatively affected by Russia's war of aggression against Ukraine and the energy price shock, GDP growth is projected at 0.6 per cent in 2023, before rising to 0.9 per cent in 2024 and 1.5 per cent in 2025. China is expected to grow at a rate of 5.2 per cent this year, before growth falls to 4.7 per cent in 2024 and 4.2 per cent in 2025 due to continued stresses in the property sector and continued high household savings rates.

"The global economy continues to face the challenges of low growth and high inflation, with a slight slowdown next year, mainly as a result of the necessary tightening of monetary policy over the past two years. Inflation has declined from last year's highs. We expect inflation to return to central bank targets by 2025 in most economies," stresses OECD Secretary-General Mathias Cormann.

"In the longer term, our projections show a significant increase in public debt, partly as a result of a further slowdown in growth. Greater efforts are needed to rebuild fiscal space, while also boosting growth. To ensure stronger growth, we need to boost competition, investment and skills and enhance multilateral cooperation to address common challenges, such as revitalising global trade flows and implementing transformative action on climate change," it adds.

The outlook highlights a number of risks. Geopolitical tensions remain a key source of uncertainty and have increased further as a result of the evolving conflict following the Hamas terrorist attacks against Israel. In a context of heightened geopolitical tensions and a long-term decline in the trade intensity of growth, the expected cyclical pick-up in trade growth may not materialise. On the positive side, higher consumer spending could boost growth if households make greater use of savings accumulated since the COVID-19 pandemic, although this could also increase inflation persistence.

Recommendations

The report reflects a number of policy recommendations, underlining the need for continued policies aimed at reducing inflation, reviving global trade and adapting fiscal policy to address longer-term challenges.

The effects of monetary policy tightening from early 2022 are becoming increasingly visible. Policy rates appear to be at or near their peak in most economies. Monetary policy should remain tight until there are clear signs that inflationary pressures have been durably reduced. Rate cuts are not expected in major advanced economies until well into 2024, and in some economies not before 2025. There is scope for rate cuts in many emerging market economies, but global financial conditions will limit the pace at which they can occur. Greater efforts must be made to ensure that markets remain open to help lead the way towards digital and green transitions. Fiscal policy must prepare for long-term spending challenges.

"Governments really need to start addressing the growing challenges facing public finances, particularly population ageing and climate change," said OECD Chief Economist Clare Lombardelli. "Governments need to spend more wisely and policymakers need to contain current and future fiscal pressures, while preserving investment and rebuilding buffers to respond to future shocks," she concludes.

Translated from Spanish using DeepL.

- Take advantage of InvestingPro's half-price Cyber Monday deal now! And if you prefer, you can also benefit from a 10% discount on a 2-year subscription to InvestingPro+ with the code ukextra10.