By William Schomberg and David Milliken

LONDON (Reuters) - Britain's economy could be facing a slower recovery from its deep coronavirus slump than the Bank of England suggested this month and all stimulus options, including sub-zero interest rates, should be considered, a BoE deputy governor said.

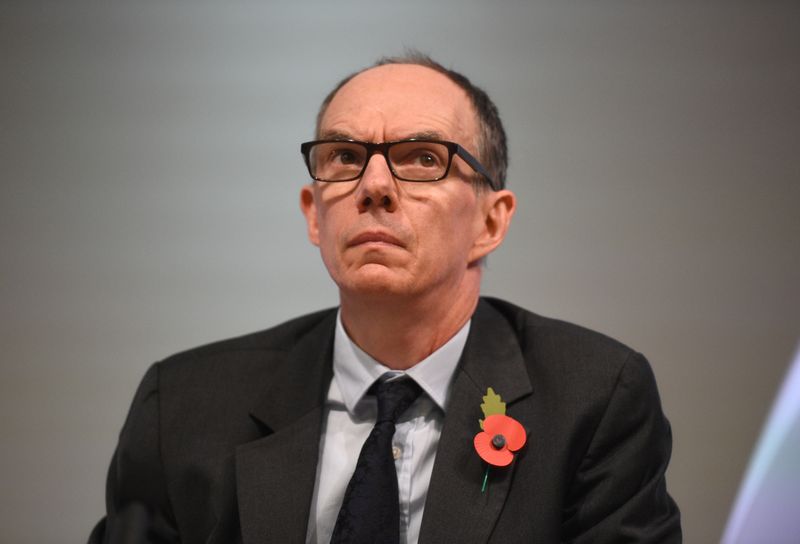

But Dave Ramsden told Reuters the issues around taking rates below zero were complex and would take time to think through, and there was plenty of room for the BoE to carry on its massive programme of government bond purchases.

The BoE said on May 7 that Britain's economy might suffer its sharpest slump in over 300 years in 2020 after the government imposed a shutdown to slow the spread of COVID-19.

While stressing the huge uncertainties about the outlook, the central bank said the economy could get back to its pre-pandemic size by the second half of 2021.

Ramsden said the BoE's scenario saw investment cuts by businesses causing long-term economic damage.

"But there will be other mechanisms for scarring," he said.

Some companies might have to permanently downsize or fold altogether because "they just didn't fit sufficiently with what the current post-COVID world looks like".

Persistently high unemployment was also a danger even if Britain's labour market had typically been more robust than expected after other recent economic shocks.

"We were very clear in May that we saw the risks on balance to the downside," Ramsden said.

At the same time, a 25% economic contraction between April and June included in the BoE's scenario might prove too steep.

"If you took a literal read on some of the fast indicators for the UK, and also looking at other countries and how they are responding to the end of their lockdowns, you might think, well, maybe the fall in Q2 isn't going to be quite as precipitous as we had it in May," he said.

"But could it persist for a bit longer? That's an open question and these are very, very early days."

JUNE STIMULUS?

The BoE's Monetary Policy Committee is due to meet again next month.

Most economists expect it will expand further its war chest for buying bonds, most of them issued by Britain's government, which is borrowing heavily to prop up the economy.

"I am certainly not going to rule it out," Ramsden said when asked about the possibility of an increase to the bond-buying programme, which the BoE bolstered by a record 200 billion pounds as recently as March to 645 billion pounds.

"It's quite possible that we could do more at that meeting or at subsequent meetings. But we will make that decision at the time," he said.

As the BoE's deputy governor for markets and banking, Ramsden is responsible for its asset purchase programme and an array of liquidity operations to keep the financial system pumping.

Several of the multi-billion pound programmes were launched as the coronavirus crisis escalated and are now run by BoE staff who are largely working from home.

Financial markets have calmed down from the panicked selling of British gilts and other normally safe assets in March.

"That improved position in markets is not to be taken for granted. I think the situation's still fragile," Ramsden said.

The BoE's stock of bonds has jumped from the equivalent of 25% of Britain's annual economic output to 33% in just a few weeks, an unprecedented surge in its balance sheet.

Ramsden said the BoE still had "quite a lot of headroom" to buy more gilts, but the pace of purchases could be adjusted.

"We have the potential to flex any purchase programme. We haven't done that in May. We are continuing with the current programme. But we keep a close eye on this kind of thing. The current pace of the programme, I should stress."

ACTIVE ON NEGATIVE RATES

As for other, more radical policies, Ramsden echoed comments of Governor Andrew Bailey this week who said he was ruling nothing out and nothing in.

"We are keeping our whole tool-set under active review," Ramsden said.

It was "perfectly reasonable to have an open mind on negative rates," he said, but the BoE had to understand how they might affect Britain's banking system and how they had worked in other economies in periods different to the current situation.

"These are really serious issues where you can't just say, 'Oh, this happened in this episode in another country, so let's therefore apply it to the UK.' You need to work through the consequences," Ramsden said.

On expanding the BoE's corporate bond purchases to include riskier debt - an option floated by BoE Chief Economist Andy Haldane - Ramsden said the potential for boosting growth and smoothing out markets would need to be looked at, and Britain's finance ministry would have to commit to meeting any losses.

But Ramsden ruled out another possibility mentioned in financial markets recently - broadening the BoE's government bond purchases to include inflation-linked bonds and debt shorter than three years in duration.

"The fundamentals of (the existing bond-buying programme) work. That's why index-linked, going shorter than three years, for me, that's not on the agenda."