By Krishna N. Das and Karen Lema

MANILA (Reuters) - Rizal Commercial Banking Corp (RCBC) officials say they have preserved ties with major U.S. banks despite the use of one of its branches in Manila by cyber criminals to funnel $81 million (62 million pounds) stolen from the Bangladesh central bank’s account at the Federal Reserve Bank of New York.

The money was sent to RCBC by three of its so-called correspondent banks, Wells Fargo (NYSE:WFC), Citigroup’s Citibank and the Bank of New York Mellon (NYSE:BK), in February, before mostly being laundered through the Philippines' casino industry. Only $18 million has been recovered.

"The relationships continue," Maria Celia Estavillo, RCBC's legal and regulatory affairs head, said in an interview at the bank's headquarters in Manila.

"Ours is a very old bank and the relationships are long standing, so I don't foresee our relationships would be discontinued. I guess there were questions that we answered," she said in her first interview since a Philippines' senate hearing into the heist ended in May.

Spokespeople for Citibank, Wells and BNY Mellon all declined to comment.

A correspondent bank provides services, such as facilitating wire transfers or accepting deposits, on behalf of another bank.

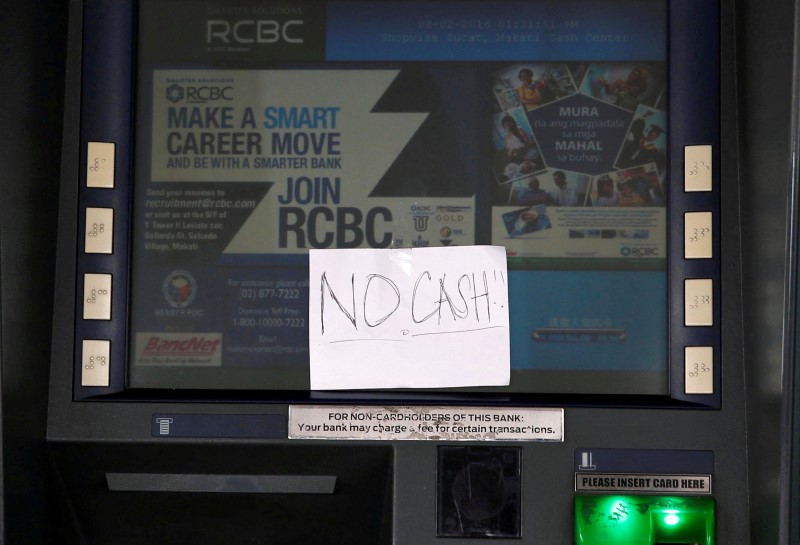

RCBC was fined a record one billion pesos (16 million pounds) by the Philippine central bank on Friday, about one fifth of its net profit last year, for its failures in preventing the Bangladesh Bank money from being transferred through accounts at the bank.

RCBC instituted "many changes" before holding review meetings with Wells, Citibank, and BNY Mellon a few weeks after the heist, according to Estavillo.

Dennis Bancod, operations head at RCBC, said the three banks had validated the new procedures.

Since the heist, RCBC has lowered the threshold level of remittances that trigger alerts and formed separate control units at its branches to double-check doubtful transactions, said the bank officials.

According to a former executive involved with security at a major U.S. bank it is rare for banks to sever ties with another institution over money laundering issues, provided security and oversight are improved. There is a bias toward continuing ties in the interests of customers, this source said.

RCBC has blamed a couple of "rogue" officials at its Jupiter Street branch in Manila for "lapses" that allowed the stolen money to leave the bank within a few days of being stolen from the account at the Fed.

But the Bangladesh central bank has alleged that the money disappeared because of systemic failures at RCBC and not just mistakes by individuals.

After a series of meeting with authorities in the Philippines last week, a delegation from Bangladesh Bank said that Philippine President Rodrigo Duterte had given a commitment that the stolen money would be returned.

Bangladesh Bank has said it may sue RCBC if other efforts to recover the money fail. Estavillo said there was no way RCBC would pay any money to Bangladesh Bank without a court order.