By Carolyn Cohn and Kirstin Ridley

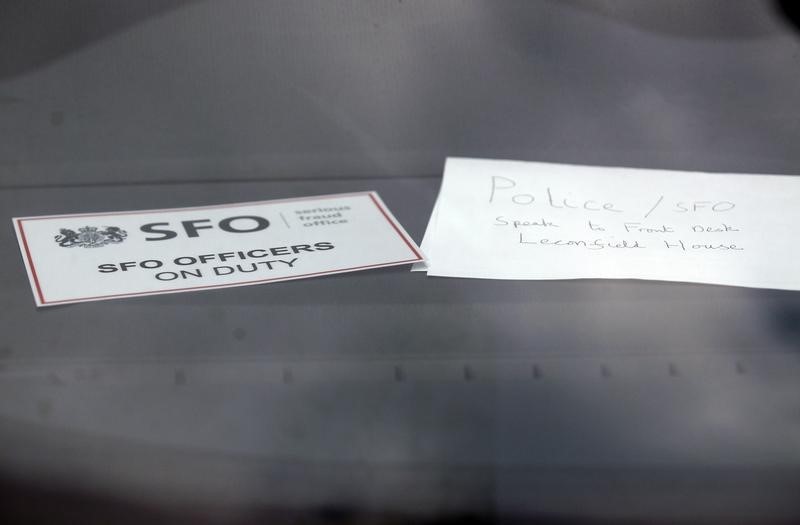

LONDON (Reuters) - Three men were jailed for masterminding a 23 million pound biofuel investment scam on Monday, in the first convictions by Britain's Serious Fraud Office (SFO) under tough new anti-bribery laws.

The Britons were executives or agents of Sustainable AgroEnergy Plc, a company that promoted biofuel investment products linked to southeast Asian plantations of jatropha trees, once considered a wonder plant in the hunt for oil.

"These three individuals preyed on investors, many of whom were duped into investing life savings and pension funds," SFO director David Green said.

The convictions are a welcome break for the SFO, which has been trying to restore confidence in its ability to bring criminals and companies to book after a series of failures in high-profile cases. An inspection report last month found the agency had made mixed progress in tackling its shortcomings.

The SFO had been expected to be the leading prosecutor to use the Bribery Act, which came into force in 2011 to overhaul 122-year-old laws that were criticised for not giving prosecutors the tools to fight modern international crime.

Previous charges under the Act, however, had been brought by its sister prosecutor the Crown Prosecution Service (CPS).

A jury at London's Southwark Crown Court found Gary West, 52, James Whale, 38, and Stuart Stone, 28, guilty of defrauding British investors between April 2011 and Feb. 2012, the SFO said. They were jailed for 13, 9, and 6 years respectively.

All three were charged with fraud-related offences and West and Stone with bribery or receiving bribes in breach of the Bribery Act. A fourth man was acquitted of all charges against him.

"The SFO has taken an important step forward in demonstrating its ability to police the Bribery Act," said Omar Qureshi, head of anti-corruption at law firm CMS.

The Act has been called one of the world's toughest anti-corruption laws. Bribery offences committed by individuals now carry a penalty of up to 10 years' imprisonment, an unlimited fine and confiscation of assets.

However, the SFO remains under pressure to bring a case under the much-debated section 7 of the Act, which introduced an offence of "failure to prevent bribery", whereby a company can be prosecuted for failing to have "adequate procedures" to prevent active bribery by "associated persons".

Companies are also keen to see whether a corporate prosecution under this part of the Act will shed light on their liability for the conduct of such associated persons - and what the scope of the "adequate procedures" is.

(Editing by Pravin Char)