Proactive Investors - UK new private car registrations rose 0.1% last month to around 32,100, while total sales, including business and fleet purchases, were down 1.2% year-on-year at roughly 84,600.

Battery electric car demand rose 10.8% as buyers responded to heavy discounting by most carmakers this spring and summer and the launch of several new models, the Society of Motor Manufacturers reported.

The market share for battery EVs rose to 17.2% last month, and the trade body forecasts it to rise further to 18.5% by the end of the year thanks to increasing choice of models, with around 364,000 BEV registrations predicted for 2024 as a whole.

The SMMT said this will still be shy of the 22% share required by the government's zero-emission vehicle mandate.

While EV growth is welcome, August is always a very low volume month, said SMMT chief executive Mike Hawes, subject to distortions ahead of September’s number plate change.

September's introduction of the new 74 number plate, together with a raft of offers and discounts from manufacturers, plus growing choice of EV and other models, "will help increase purchase consideration and be a true barometer for market demand," Hawes said.

"Encouraging a mass market shift to EVs remains a challenge, however, and urgent action must be taken to help buyers overcome affordability issues and concerns about chargepoint provision."

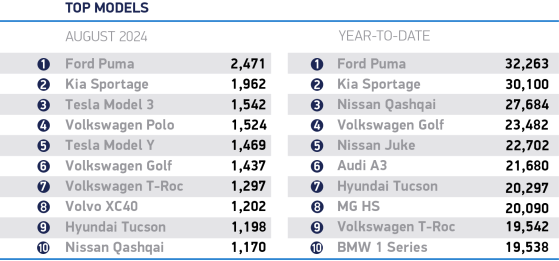

The best-selling model this year remains the Ford Puma, followed by the Kia Sportage and Tesla Model 3 in August.

Some new models cost under £25,000, such as the Citroen e-C3 at £22K, and with a couple now priced below £20,000.

The cheapest is the Citroen Ami, at £8,000, though technically it is a quadricycle, with AutoCar calling the UK's cheapest 'proper EV' the Dacia Spring, at £15K.

Read more on Proactive Investors UK