By Geoffrey Smith

Investing.com -- Germany posted its first monthly trade deficit in over 30 years in May as the price of its oil and gas imports soared in the pull of Russia's war in Ukraine.

Europe's largest country, whose economic model has been built on substantial trade surpluses since the Second World War, swung to a deficit of €1.0 billion ($1.04 billion) in May, as its import bill surged by nearly 28% from a year earlier. Imports were up 2.7% from April.

At the same time, exports fell for the third time in five months, by 0.5% in calendar- and seasonally-adjusted terms, but were still up 11.7% on the year.

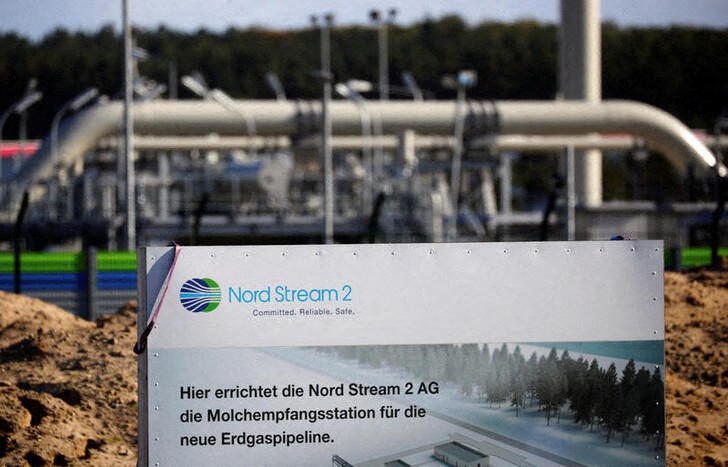

The data are a powerful illustration of the problems facing Germany, whose dependence on Russian energy was brutally exposed by the war. The deficit is set to widen in June, reflecting a 60% cut in Russian gas supplies that forced importers to cover their obligations by buying on the spot market at much higher prices. Many German analysts fear a complete stop to Russian supplies in the second half of the year.

The news comes at the start of a day when German Chancellor Olaf Scholz is set to hold crisis talks with union and employers' representatives in Berlin on the state of the economy.

“Entire industries are in danger of collapsing forever because of the gas bottlenecks," Yasmin Fahimi, the head of the German Federation of Trade Unions, told the newspaper Bild am Sonntag in an interview at the weekend, singling out the chemicals, glass-making, and aluminum industries, all of which are major suppliers to the key automotive sector. "Such a collapse would have massive consequences for the entire economy and jobs in Germany,” she added.

The euro has fallen some 7.4% against the dollar since the war started, hitting a five-year low in May. It was unchanged at $1.0434 by 03:10 AM ET (0710 GMT).